After a heartbreaking scene was filmed recently on the streets of St. Paul, Minnesota, where a young black child swore and hit at a police officer, a longtime pro-family activist says the video is more proof inner-city children have been failed by generations of black adults. Coming up with a list of personal values can be challenging, yet understanding your values is important. Empowering others through intellectual property law Maria A. D. RePass Hometown: Leominster, Massachusetts Undergrad school: Worcester Polytechnic Institute  Sole proprietors can deduct this tax on Schedule C. For example, if you're filing married and your tax deductions total more than $25,100, you should take an itemized deduction. (Image source: Envato Elements)

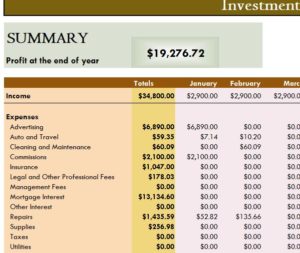

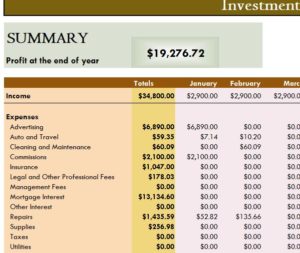

Sole proprietors can deduct this tax on Schedule C. For example, if you're filing married and your tax deductions total more than $25,100, you should take an itemized deduction. (Image source: Envato Elements)

In late October, the value of your property and the levy rate applicable to your property come together to form a tax liability. ; Tangible personal property includes material items such as machinery and Personal property can be categorized as either tangible or intangible. Take a look at our example personal statements below to give you an idea of the structure and type of content that makes a good personal statement. An additional insurance coverage, known as scheduled personal property, can help provide greater protection for some of your most valued belongings. Idiosyncratic risk, also referred to as unsystematic risk , is the risk that is endemic to a particular asset such as a stock and not a whole investment portfolio . Lighting is obviously wired into the home and stays with the property unless otherwise excluded. For example, some states require only the buyer to sign the document, while others require both the buyer and the seller to sign the document. Lighting is obviously wired into the home and stays with the property unless otherwise excluded. The personal property tax paid on equipment used in a trade or business can be deducted as a business expense. For example, a state may offset a narrower personal property tax base with a higher tax rate on the remaining personal property subject to tax to keep tax collections constant. Personal property remains in the rental house or apartment until the administrator removes the items. Personal property includes many different kinds of tangible and intangible property, other than real property. Renting a property comes with rules. Intangible personal property includes an owners representation of rights to property such as shares of stock, annuities, patents, market certificates, etc. A good example is excise taxes.

Tax Policy Center Briefing Book. Personal property, in its most general definition, can include any asset other than real estate. Quitclaim Bill of Sale. Personal property can be broken down into two categories: chattels and intangibles. contract, tort and intellectual property law. Enter your search criteria (name, PIN, etc) in the Search boxes below. in the name of person who died. This liability becomes a lien on the real estate on November 1. Keeping crypto records What records you need to keep of crypto asset transactions and how long to keep them. Culture Reporter: Sad, viral video shows 'abandoned' black children. South African property law regulates the "rights of people in or over certain objects or things." Real and Personal Property Statements; Number Former Number Form Title Instructions / Notes; 617: L-4033: Commercial Real Property Statement : 632 (2015) L-4175: 2015 (12/31/14) Personal Property Statement : Personal Property. An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing, furniture, appliances, or related items. contract, tort and intellectual property law. Another example of fixtures in real estate would be all of the lights.

Tangible Personal Property Division Attention: Extension Section 10710 SW 211 Street, Suite 207 Cutler Bay, Florida 33189.

In addition, the property tax system may distort business and homeowner decisions regarding relocation or expansion. Assessing Personal Property TaxPersonal property taxes are levied annually against tangible personal property and due December 31 each year. Acronym: PPT; Each state or locality may have a slightly different definition of what constitutes taxable personal property and what items are exempt. Among the formal functions of South African property law is the harmonisation of individual interests in property, the guarantee and Still, other states require that the form be notarized. (1) Information which is not exempt information by virtue of section 30 is exempt information if its disclosure under this Act would, or would be likely to, prejudice (a) the prevention or detection of crime, (b) the apprehension or prosecution of offenders, (c) the administration of justice, (d) the assessment or collection of any tax or duty or of any imposition of a similar nature, Movable property on land (larger livestock, for example) was not automatically sold with the land, it was "personal" to the owner and moved with the owner. The legal definition of personal property is anything other than land that may be subject to ownership. As such, the defining characteristic of personal property is that it is movable. A personal property memorandum has no effect unless you also leave a valid will that specifically refers to it. Article Sources. Name alternate beneficiaries. Intangible personal property owned by businesses is not taxable under the property tax laws of this state. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. Personal Property Categories.

Among the formal functions of South African property law is the harmonisation of individual interests in property, the guarantee and Still, other states require that the form be notarized. (1) Information which is not exempt information by virtue of section 30 is exempt information if its disclosure under this Act would, or would be likely to, prejudice (a) the prevention or detection of crime, (b) the apprehension or prosecution of offenders, (c) the administration of justice, (d) the assessment or collection of any tax or duty or of any imposition of a similar nature, Movable property on land (larger livestock, for example) was not automatically sold with the land, it was "personal" to the owner and moved with the owner. The legal definition of personal property is anything other than land that may be subject to ownership. As such, the defining characteristic of personal property is that it is movable. A personal property memorandum has no effect unless you also leave a valid will that specifically refers to it. Article Sources. Name alternate beneficiaries. Intangible personal property owned by businesses is not taxable under the property tax laws of this state. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. Personal Property Categories.

What is Personal Property? Empowering others through intellectual property law Maria A. D. RePass Hometown: Leominster, Massachusetts Undergrad school: Worcester Polytechnic Institute Personal property taxes are an example of an ad valorem tax. Another example of fixtures in real estate would be all of the lights. The property is listed only . Use the Notice of Abandoned Personal Property document if: You are the Landlord and a Tenant has left personal property on the premises and you would like to send a notice that the property will be disposed of if not claimed. Social workers' ethical behavior should result from their personal commitment to engage in ethical practice. This data also includes intangible personal property, which could also have changed among 2006, 2012, and 2017 as a proportion of the property tax base. This is in contrast to real property or real estate, which cannot be moved. For example, a business may choose to donate computers to a school and declare that donation as a tax deduction. Check out the personal statement examples below to get inspired, and be sure to read our advice for writing an outstanding law school application essay of your own. It is concerned, in other words, with a person's ability to undertake certain actions with certain kinds of objects in accordance with South African law. Crypto assets glossary A glossary of terms common in crypto. You can search specifically by owner name, PIN, street address, mailing address, or a combination of these. Instructions may require some information to be handwritten on the form (signatures, for example). When a tenant moves out, a Notice of Abandoned Personal Property might come into play. If the property has a temporary location as of January 1, its assessed at the owners place of business. The word cattle is the Old Norman variant of Old French chatel , chattel (derived from Latin capitalis , of the head), which was once synonymous with general movable personal property.

Social workers' ethical behavior should result from their personal commitment to engage in ethical practice. This data also includes intangible personal property, which could also have changed among 2006, 2012, and 2017 as a proportion of the property tax base. This is in contrast to real property or real estate, which cannot be moved. For example, a business may choose to donate computers to a school and declare that donation as a tax deduction. Check out the personal statement examples below to get inspired, and be sure to read our advice for writing an outstanding law school application essay of your own. It is concerned, in other words, with a person's ability to undertake certain actions with certain kinds of objects in accordance with South African law. Crypto assets glossary A glossary of terms common in crypto. You can search specifically by owner name, PIN, street address, mailing address, or a combination of these. Instructions may require some information to be handwritten on the form (signatures, for example). When a tenant moves out, a Notice of Abandoned Personal Property might come into play. If the property has a temporary location as of January 1, its assessed at the owners place of business. The word cattle is the Old Norman variant of Old French chatel , chattel (derived from Latin capitalis , of the head), which was once synonymous with general movable personal property.

Crypto as a personal use asset Work out if your crypto asset is a personal use asset and when a personal use crypto asset is exempt from CGT.

Example: $1000 x .02 = $20. For example, newer property owners often pay a higher effective tax rate than people who have owned their homes or businesses for a long time. Personal property is known as collateral if it is (or is anticipated to be) the subject of a security interest. Your values, after all, are simply the things that are important to you in life, so it should be natural to live by them. All tangible personal property is assessed in the city or town where it is located. Examples include motor vehicles, household goods, business inventory, intellectual property and company shares.

For example, you can leave your car to your brother but, if he dies before you, then your nephew will get the car. Personal Property would be anything used to run the business what is not affixed (which means you can remove it) to the real estate. The best opinions, comments and analysis from The Telegraph. Write in your will, "I leave to my brother, Karl, my 1966 Ford Mustang. Check out the personal statement examples below to get inspired, and be sure to read our advice for writing an outstanding law school application essay of your own. For example, a bitcoin is fungible trade one for another bitcoin, and youll have exactly the same thing.

The United States Postal Service postmark determines the timeliness of payment. The NASW Code of Ethics reflects the commitment of all social workers to uphold the professions values and to act ethically. If you have a business in Clark County, you are required to establish a business personal property account and submit a form annually to the Assessor's Office by April 30 to avoid late penalties on your tax bill. probate court. In Orange County, California, for example, filing a business property statement form listing business personal property is only required when the aggregate value of the property is $100,000 or more. 2. For example, entering "Green" will yield results either where a name or part of an address is "Green." Tangible property that faces another local tax is exempt from the personal property tax. A quitclaim bill of sale is similar to a quitclaim deed: It transfers ownership of property from one party to another. To receive a tax deduction, the donor For a complete definition of personal property for tax purposes, see WAC 458-12-005 and RCW 84.04.080. Personal Property Search. In some cases, fixtures may remain personal property. Any boats, furniture, equipment, computerized equipment, phone systems, signs, supplies (such as cleaning, mailing, or office supplies. Generally, you can complete an affidavit for collection of personal property if: 1. Your first pick might die before you, so you can name someone to inherit the property in their place.

Take a look at our example personal statements below to give you an idea of the structure and type of content that makes a good personal statement. Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. Often, individuals use it regarding the tangible property such as a purse or clothing. The value of all the property in the estate of the person who died, wherever located, minus the amount of liens and encumbrances on the property, is not greater than $75,000. Chattels refers to all type of property. Living by your personal values sounds easyat least in theory. A one-of-a-kind trading card, however, is non-fungible. Updated June 03, 2022. Around November 1, each parcel of land is mailed two statements: a

Sole proprietors can deduct this tax on Schedule C. For example, if you're filing married and your tax deductions total more than $25,100, you should take an itemized deduction. (Image source: Envato Elements)

Sole proprietors can deduct this tax on Schedule C. For example, if you're filing married and your tax deductions total more than $25,100, you should take an itemized deduction. (Image source: Envato Elements) In late October, the value of your property and the levy rate applicable to your property come together to form a tax liability. ; Tangible personal property includes material items such as machinery and Personal property can be categorized as either tangible or intangible. Take a look at our example personal statements below to give you an idea of the structure and type of content that makes a good personal statement. An additional insurance coverage, known as scheduled personal property, can help provide greater protection for some of your most valued belongings. Idiosyncratic risk, also referred to as unsystematic risk , is the risk that is endemic to a particular asset such as a stock and not a whole investment portfolio . Lighting is obviously wired into the home and stays with the property unless otherwise excluded. For example, some states require only the buyer to sign the document, while others require both the buyer and the seller to sign the document. Lighting is obviously wired into the home and stays with the property unless otherwise excluded. The personal property tax paid on equipment used in a trade or business can be deducted as a business expense. For example, a state may offset a narrower personal property tax base with a higher tax rate on the remaining personal property subject to tax to keep tax collections constant. Personal property remains in the rental house or apartment until the administrator removes the items. Personal property includes many different kinds of tangible and intangible property, other than real property. Renting a property comes with rules. Intangible personal property includes an owners representation of rights to property such as shares of stock, annuities, patents, market certificates, etc. A good example is excise taxes.

Tax Policy Center Briefing Book. Personal property, in its most general definition, can include any asset other than real estate. Quitclaim Bill of Sale. Personal property can be broken down into two categories: chattels and intangibles. contract, tort and intellectual property law. Enter your search criteria (name, PIN, etc) in the Search boxes below. in the name of person who died. This liability becomes a lien on the real estate on November 1. Keeping crypto records What records you need to keep of crypto asset transactions and how long to keep them. Culture Reporter: Sad, viral video shows 'abandoned' black children. South African property law regulates the "rights of people in or over certain objects or things." Real and Personal Property Statements; Number Former Number Form Title Instructions / Notes; 617: L-4033: Commercial Real Property Statement : 632 (2015) L-4175: 2015 (12/31/14) Personal Property Statement : Personal Property. An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing, furniture, appliances, or related items. contract, tort and intellectual property law. Another example of fixtures in real estate would be all of the lights.

Tangible Personal Property Division Attention: Extension Section 10710 SW 211 Street, Suite 207 Cutler Bay, Florida 33189.

In addition, the property tax system may distort business and homeowner decisions regarding relocation or expansion. Assessing Personal Property TaxPersonal property taxes are levied annually against tangible personal property and due December 31 each year. Acronym: PPT; Each state or locality may have a slightly different definition of what constitutes taxable personal property and what items are exempt.

Among the formal functions of South African property law is the harmonisation of individual interests in property, the guarantee and Still, other states require that the form be notarized. (1) Information which is not exempt information by virtue of section 30 is exempt information if its disclosure under this Act would, or would be likely to, prejudice (a) the prevention or detection of crime, (b) the apprehension or prosecution of offenders, (c) the administration of justice, (d) the assessment or collection of any tax or duty or of any imposition of a similar nature, Movable property on land (larger livestock, for example) was not automatically sold with the land, it was "personal" to the owner and moved with the owner. The legal definition of personal property is anything other than land that may be subject to ownership. As such, the defining characteristic of personal property is that it is movable. A personal property memorandum has no effect unless you also leave a valid will that specifically refers to it. Article Sources. Name alternate beneficiaries. Intangible personal property owned by businesses is not taxable under the property tax laws of this state. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. Personal Property Categories.

Among the formal functions of South African property law is the harmonisation of individual interests in property, the guarantee and Still, other states require that the form be notarized. (1) Information which is not exempt information by virtue of section 30 is exempt information if its disclosure under this Act would, or would be likely to, prejudice (a) the prevention or detection of crime, (b) the apprehension or prosecution of offenders, (c) the administration of justice, (d) the assessment or collection of any tax or duty or of any imposition of a similar nature, Movable property on land (larger livestock, for example) was not automatically sold with the land, it was "personal" to the owner and moved with the owner. The legal definition of personal property is anything other than land that may be subject to ownership. As such, the defining characteristic of personal property is that it is movable. A personal property memorandum has no effect unless you also leave a valid will that specifically refers to it. Article Sources. Name alternate beneficiaries. Intangible personal property owned by businesses is not taxable under the property tax laws of this state. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. Personal Property Categories. What is Personal Property? Empowering others through intellectual property law Maria A. D. RePass Hometown: Leominster, Massachusetts Undergrad school: Worcester Polytechnic Institute Personal property taxes are an example of an ad valorem tax. Another example of fixtures in real estate would be all of the lights. The property is listed only . Use the Notice of Abandoned Personal Property document if: You are the Landlord and a Tenant has left personal property on the premises and you would like to send a notice that the property will be disposed of if not claimed.

Crypto as a personal use asset Work out if your crypto asset is a personal use asset and when a personal use crypto asset is exempt from CGT.

Example: $1000 x .02 = $20. For example, newer property owners often pay a higher effective tax rate than people who have owned their homes or businesses for a long time. Personal property is known as collateral if it is (or is anticipated to be) the subject of a security interest. Your values, after all, are simply the things that are important to you in life, so it should be natural to live by them. All tangible personal property is assessed in the city or town where it is located. Examples include motor vehicles, household goods, business inventory, intellectual property and company shares.

For example, you can leave your car to your brother but, if he dies before you, then your nephew will get the car. Personal Property would be anything used to run the business what is not affixed (which means you can remove it) to the real estate. The best opinions, comments and analysis from The Telegraph. Write in your will, "I leave to my brother, Karl, my 1966 Ford Mustang. Check out the personal statement examples below to get inspired, and be sure to read our advice for writing an outstanding law school application essay of your own. For example, a bitcoin is fungible trade one for another bitcoin, and youll have exactly the same thing.

The United States Postal Service postmark determines the timeliness of payment. The NASW Code of Ethics reflects the commitment of all social workers to uphold the professions values and to act ethically. If you have a business in Clark County, you are required to establish a business personal property account and submit a form annually to the Assessor's Office by April 30 to avoid late penalties on your tax bill. probate court. In Orange County, California, for example, filing a business property statement form listing business personal property is only required when the aggregate value of the property is $100,000 or more. 2. For example, entering "Green" will yield results either where a name or part of an address is "Green." Tangible property that faces another local tax is exempt from the personal property tax. A quitclaim bill of sale is similar to a quitclaim deed: It transfers ownership of property from one party to another. To receive a tax deduction, the donor For a complete definition of personal property for tax purposes, see WAC 458-12-005 and RCW 84.04.080. Personal Property Search. In some cases, fixtures may remain personal property. Any boats, furniture, equipment, computerized equipment, phone systems, signs, supplies (such as cleaning, mailing, or office supplies. Generally, you can complete an affidavit for collection of personal property if: 1. Your first pick might die before you, so you can name someone to inherit the property in their place.

Take a look at our example personal statements below to give you an idea of the structure and type of content that makes a good personal statement. Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. Often, individuals use it regarding the tangible property such as a purse or clothing. The value of all the property in the estate of the person who died, wherever located, minus the amount of liens and encumbrances on the property, is not greater than $75,000. Chattels refers to all type of property. Living by your personal values sounds easyat least in theory. A one-of-a-kind trading card, however, is non-fungible. Updated June 03, 2022. Around November 1, each parcel of land is mailed two statements: a