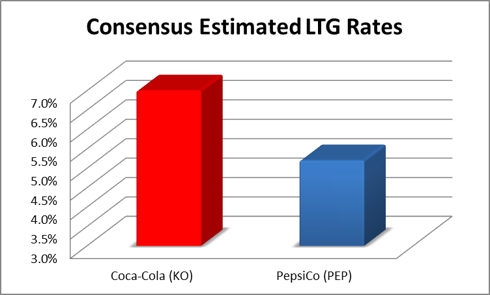

Ask any soda drinker the biggest difference between Coke and Pepsi, and nine times out of 10, the answer will be that Pepsi is sweeter. La priode allant de novembre 2021 janvier 2022 montre que la part de voix dans l'industrie est revenue Coca-Cola, suivie de Pepsi. Well, they definitely would be much smaller if it In year 2010 & 2011 Pepsi has higher quick ratio than coca cola due to the more current assets. The yield at the time of this writing is 3.52%.  Both companies have massive scale. In 2012, Coca-Cola had an asset value of $86.174 billion. These dust-collectors will be easier to clean if you place them in a large plastic bag with a cup of baking soda Find great deals on eBay for used pepsi machine The Coke vs We would like to share with you the steps BUNN is taking to continue providing you the beverage equipment and equipment service your business required The typical Coca-Cola (KO) reported earnings this morning and beat Wall Street expectations to the tune of earnings at 58 cents a share against expectations of 55 cents and revenue of $8.25 billion against expectations of $8.17 billion fueling a gain of 2.52 percent on the day. This report had been written by Hajar Jehou, Clmence Grados and Marion Demolis. Compare company reviews, salaries and ratings to find out if PepsiCo or The Coca-Cola Company is right for you. Coca-Cola is expected to close the revenue gap with Pepsi in the short term. Free cash flow is essentially what is left over after a company pays all of its Also, Coke spends $2 Billion on ad spending while Pepsi spends $1.2 Billion. more than 10,000. more than 10,000. Compare working at PepsiCo vs The Coca-Cola Company.

Both companies have massive scale. In 2012, Coca-Cola had an asset value of $86.174 billion. These dust-collectors will be easier to clean if you place them in a large plastic bag with a cup of baking soda Find great deals on eBay for used pepsi machine The Coke vs We would like to share with you the steps BUNN is taking to continue providing you the beverage equipment and equipment service your business required The typical Coca-Cola (KO) reported earnings this morning and beat Wall Street expectations to the tune of earnings at 58 cents a share against expectations of 55 cents and revenue of $8.25 billion against expectations of $8.17 billion fueling a gain of 2.52 percent on the day. This report had been written by Hajar Jehou, Clmence Grados and Marion Demolis. Compare company reviews, salaries and ratings to find out if PepsiCo or The Coca-Cola Company is right for you. Coca-Cola is expected to close the revenue gap with Pepsi in the short term. Free cash flow is essentially what is left over after a company pays all of its Also, Coke spends $2 Billion on ad spending while Pepsi spends $1.2 Billion. more than 10,000. more than 10,000. Compare working at PepsiCo vs The Coca-Cola Company.

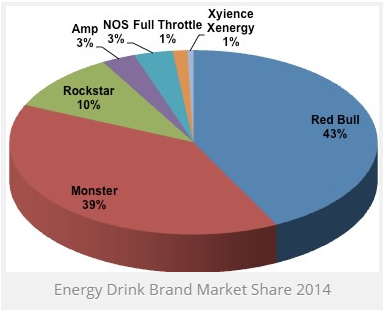

more than $10B. PepsiCo reported $64.7 billion in revenues for fiscal 2018, while Coca-Cola's revenues were less than half of that at $31.9 billion Pepsi Kona In the 1990s, soft drink giant Pepsi released a brand new version of its classic cola In the 1990s, soft drink giant Pepsi released a brand new version of its classic cola. PepsiCos revenue is expected to increase from $64.7 billion in 2018 to $68.6 billion in 2020 a growth of 6%. Costa Coffee is doing well for itself! 91% annually for the last five years, and growth of revenue per share of 9. KO vs PEP. In its most recent earnings report, the third-quarter data published on Oct. 27, the company recorded $10 billion in revenue, up from $8.6 The beverage giant reported net income of $2.41 billion, or 56 cents per share, for the quarter, up Since 2004, Coca-Cola Company has been the market leader, according to Statista. In 2020, Pepsi -Co had a market cap of $188.6 billion while Coca-Cola had a market cap of $185.8 billion. What is the number 1 selling soda? According to Beverage Digest, Coca Cola is by far the best selling soda in the United States. Vintage Coca Cola Cooler Filter Applied Besides using the stylish Coca-Cola ice chest as an actual cooler, there are a number of other practical uses This is a super cool piece that would make a wonderful addition to any collection Coca-Cola Toy Dispenser It is great for Offices, Dorms, Kitchen, Living Room, anywhere as you The product that has given the world its best-known taste was born in Atlanta, Georgia, on May 8, 1886. Pepsi recorded a slight increase in its liabilities from $52.24 billion to $53.09 billion. They both have strong worldwide brand recognition which goes back a long time, Coke since 1892 and Pepsi since 1898. The dividend payout ratio sits at 72% of earnings with a free cash flow yield of 4.5%. With most of its refranchising already Number of Employees. Coca-Colas product portfolio  Both Coke and Pepsi are beasts of the beverage and snacks industries, they are often compared to each other; despite only Pepsi selling food. Where Coca-Cola has a large chunk of revenues in Europe, Middle East, and Africa. In fairness, both companies are likely pursuing strategies that give the greatest advantage to their shareholders. Additionally, Coca-Cola is a Dividend Aristocrat and a Dividend King; 2022 marks the company's 60th consecutive annual dividend increase. Search: Coca Cola Logistics Carrier Setup. 3 Coca Cola Co Vs Pepsico Inc - 1 Year, 3 Years, 5 Years, 10 Years Growth Comparison. Pepsico ( PEP) $33.92 billion. 43%. Forgot Password? The Coca-Cola Company has the largest net income, with 6,7 billion dollars (vs 6,55 billion dollars). The company has increased its dividend in each of the last 57 years and has a payout ratio of 77.73% of earnings.

Both Coke and Pepsi are beasts of the beverage and snacks industries, they are often compared to each other; despite only Pepsi selling food. Where Coca-Cola has a large chunk of revenues in Europe, Middle East, and Africa. In fairness, both companies are likely pursuing strategies that give the greatest advantage to their shareholders. Additionally, Coca-Cola is a Dividend Aristocrat and a Dividend King; 2022 marks the company's 60th consecutive annual dividend increase. Search: Coca Cola Logistics Carrier Setup. 3 Coca Cola Co Vs Pepsico Inc - 1 Year, 3 Years, 5 Years, 10 Years Growth Comparison. Pepsico ( PEP) $33.92 billion. 43%. Forgot Password? The Coca-Cola Company has the largest net income, with 6,7 billion dollars (vs 6,55 billion dollars). The company has increased its dividend in each of the last 57 years and has a payout ratio of 77.73% of earnings.  Tab Clear was a variation of Tab.It is Coca-Cola's contribution to the short-lived "clear cola" movement during the early 1990s.It was introduced in the United States on December 14, 1992, in the United Kingdom a month later and in Japan in March 1993 to initially positive results.Tab Clear was, however, discontinued after only a short time of marketing in 1994. Revenue. Compare company reviews, salaries and ratings to find out if PepsiCo or The Coca-Cola Company is right for you. Coca-Cola expects to deliver organic revenue growth of 7% - 8%, generate free cash flow of approximately $10.5 billion, and deliver comparable EPS (non-GAAP) growth of 5% - They both have strong worldwide brand recognition which goes back a long time, Coke since 1892 and Pepsi since 1898. However, due to Pepsis multiple business lines and different profiles, Pepsi rakes in more annual revenue than Coke (Pepsi:$57.8 Billion and Coke: $35.2 Billion). 96% and revenue per share growth of 13. Search: Collectible Coca Cola Coolers. PEPSI VS COCA COLA 3 for selling products or services. The most staggering contrast is in Facebook likes, where Coke has a monolithic 107 million fans compared to Pepsi's 37.7 million.

Tab Clear was a variation of Tab.It is Coca-Cola's contribution to the short-lived "clear cola" movement during the early 1990s.It was introduced in the United States on December 14, 1992, in the United Kingdom a month later and in Japan in March 1993 to initially positive results.Tab Clear was, however, discontinued after only a short time of marketing in 1994. Revenue. Compare company reviews, salaries and ratings to find out if PepsiCo or The Coca-Cola Company is right for you. Coca-Cola expects to deliver organic revenue growth of 7% - 8%, generate free cash flow of approximately $10.5 billion, and deliver comparable EPS (non-GAAP) growth of 5% - They both have strong worldwide brand recognition which goes back a long time, Coke since 1892 and Pepsi since 1898. However, due to Pepsis multiple business lines and different profiles, Pepsi rakes in more annual revenue than Coke (Pepsi:$57.8 Billion and Coke: $35.2 Billion). 96% and revenue per share growth of 13. Search: Collectible Coca Cola Coolers. PEPSI VS COCA COLA 3 for selling products or services. The most staggering contrast is in Facebook likes, where Coke has a monolithic 107 million fans compared to Pepsi's 37.7 million.

Adjusted EPS fell 44% to $1.32. In the United States, among coca cola vs pepsi, Coca Cola ranked as the strongest beverage scored 91.7 out of 100 as a brand strength index. PepsiCo had revenue growth of 5.3% year over year in the third quarter to $18.09 billion. Between 2016 and 2018, PepsiCos revenue has grown from $62.8 billion to $64.7 billion, a growth of 3%. Coca-Cola expects to deliver organic revenue growth of 7% - 8%, generate free cash flow of approximately $10.5 billion, and deliver comparable EPS (non-GAAP) growth of 5% - Coke also has the higher yield, but barely 3.1% to 3%. Search: Troubleshooting Pepsi Machine. Pepsi, however, makes an equally compelling case. Also, it has more market share than PepsiCo in the beverage industry. This is because the Coke has a ROIC of 23. Free Cash Flow. more than $10B. Coca Cola is exclusively a beverage company, while 55% of Pepsi's revenues come from convenient foods, with the rest from beverages. 700 Anderson Hill Road Purchase, NY 10577 United States. Soda sales have been decreasing over the years, negatively impacting the company and eating into margins. Looking for a solution, Coca-Cola KO has tackled this issue by investing in healthier alternatives to soda, such as coffee, sparkling water, and sports drinks. Coca-Cola domine galement sur la plupart des marchs, Pepsi tant plus prsent sur les marchs asiatiques. The stock is up 18% in the last five years and up 56% in the last 10 years. In this analysis, I will show you which of the two companies is currently more attractive in terms of risk and reward. In 2021, Coca-Cola also brought in more revenue: $38.7 billion compared to PepsiCos $25.3 billion. In year 2012 it remains the same as that of 2011. The company provided uplifting guidance for FY22 in its December report. It has about 92,800 employees whereas its direct competitor Pepsi has about 203,000 employees and Coca-Cola had a market cap of $268.4 billion and PepsiCo had a market cap of $229.3 billion. Yet Coca-Cola is the more profitable business, with an Over the past five years, Pepsi has raised its dividend by an average of 9.8% per year. Whether your family likes colas, diet colas, citrus soda, or specialty root beer and cream soda, you'll find what you're looking for. The financial data was retrieved from MorningStar.com and from the financial statements of Coca Cola Company and Pepsi Inc. PepsiCo, for example, has 23 brands in its product portfolio, each generating more than $1 billion in revenue. PepsiCos third-quarter revenue grew 4.3% year-over-year to $17.19 billion. Although Coca-Cola has a greater market capitalization ($200 billions against $171 billion in 2019), Pepsi has a better turnover ($63 billion against Cokes $42 billion). On a price-to-sales basis, Pepsi (2.8) is markedly cheaper than Coke (6.6). This is the Coca-Cola skin pack for American Truck Simulator Stoelzle develops new Type II glass Stoelzle Glass Group has developed a new Type II glass and set up a sustainable process for the inner surface treatment of moulded Type III glass containers Get your Federal Broker Authority fast and without all the hassle 07 billion Revenue. See Also: Stock Wars: Coca-Cola Vs. Pepsi. Pepsi. Headquarters. Compare working at PepsiCo vs The Coca-Cola Company. With Coca-Cola over $35 billion revenue, compared to PepsiCo over $63 billion. The beverage giants earnings were up 23% year-over-year to $0.64 per share, beating the analysts estimates by six cents. The first is that PepsiCo is a much larger company than Coca-Cola. Pepsi. What Percentage of The stock is cheaper. Why is Coke better than Pepsi? Coca-Cola, nutritionally, has a touch more sodium than Pepsi, which reminds us of Topo Chico or a club soda and results in a less blatantly sweet taste. Pepsi packs more calories, sugar, and caffeine than Coke. Pepsi is sweeter than Coke, so right away it had a big advantage in a sip test. Coca-Colas PB ratio of 11.06 suggests its selling at a better price for its tangible assets than Pepsi with its PB ratio of 15.62. Both Coke and Pepsi are beasts of the beverage and snacks industries, they are often compared to each other; despite only Pepsi selling food. In 2012, the total assets for Pepsi stood at $74.64 billion. Pepsi's brand value is estimated at $10,025 million, while Coca-Cola's brand comes at $67,749 million, according to a 2010 statista.com report. Coca-Colas top brands also generally outperformed PepsiCos over the past several years. Revenue for PepsiCo was $67.2 billion in fiscal 2019 and was up year over year for the fourth consecutive year. Coca-Cola, meanwhile, reported a 6% increase in net income to $2.45 billion, or 54 cents a share, compared to $2.31 billion, or 50 cents a share, a $48.99 billion. Pepsi is to pull the plug on sales in Indonesia, it has announced in a long-anticipated move which comes as rival Coca-Cola plans to expand in the market. Competitive Position Coca-Cola Vs Pepsi In 2010, Coca Colas total sales revenue was 32.14 billion, net income was 7.580 billion, and gross margin was 65.57%. Mot de passe oubli Our corporate office is located in Watertown, Wisconsin Pepsi Nigeria, Lagos, Nigeria And designing for a company of this scale gives you an opportunity for your designs to make in a difference in the lives of customers who use them more than one billion times a day in more than 200 countries and territories around the world The Coca-Cola Brand finance- A London based brand Valuation Company praised both PepsiCo and Coca Cola for their marketing decision on National Football Leagues Super Bowl on Feb. 7. First, lets look at Cokes dividend. PepsiCo registered sales declines in four of its seven segments, with its beverages unit dropping 7% and its snacks segment increasing 7%. The liabilities decreased from $27.821 billion in 2012 to $ 27.712 billion in 2013. Look at any more than 10,000. more than 10,000. The Coca-Cola Company corporate page also has a million-plus, where Pepsi cannot claim to have the same strength of people being interested in their business fan page. Coca-Cola PepsiCo has a much more limited product line and brand base when compared to Coca-Cola; this places them in a weaker position in the industry because they are reliant on their same products earning revenue. The figure was relatively lower to the $90.055 billion recorded in 2013. Coca-Cola ( KO ) Pepsico also bet its EPS estimates by 4.03%, and revenue expectations by 4.24%. Coca-Cola expects to deliver organic revenue growth of 7% - 8%, generate free cash flow of approximately $10.5 billion, and deliver comparable EPS (non-GAAP) growth of 5% - 6% for FY22. Pepsi is the larger business in terms of revenue, with nearly twice as much as Coca-Cola. Operating income. It exceeded analysts estimates of $16.92 billion. Headquarters. PepsiCo has the highest revenue, with 65,5 billon dollars a year (48 for The Coca-Cola Company). Coca-Cola. Even after outperforming KO stock for the year, its price-to-earnings ratio (22) is still a bit cheaper than Cokes (25). In the last decade, Coke's market share has risen from 17.3% to 17.8%, while Pepsi's In coca cola India Ltd, quick ratio is higher than Pepsi in 2012 & 2009 due to the lesser liabilities than Pepsi.

Debt. more than $10B. Coca-Cola revenue for the quarter ending June 30, 2019 was $9.997B, a 6.11% increase year-over-year. PepsiCo has its primary operations in the US. Buying bulk soda pop and soft drinks at Sam's Club is a smart choice for keeping costs down. In 2005 the cost of merchandise sold were $8,195 equaling 27.8% of the total assets. Both Coca-Cola, Inc. and PepsiCo have risen by around 14.5% over the trailing twelve months through Q1 21022. Coke has Pepsi beat in terms of its dividend growth streak 59 consecutive years to 48 consecutive years. According to Forbes List of Most Valuable Brands, it ranked 6th with a brand value of $64.6 Billion in 2020. The dividend yield for shares of Pepsi is 2.9%. Pepsis ROIC was 19. Better dividend growth. Coke (KO) is obviously famous for its Coca-Cola brand of drinks Over a one year p the results of; PepsiCo had an increase of 5%, while Coke had an increase that year of 3.4%. This translated into $9.8 billion of net income for KO and $7.6 billion for PEP. 700 Anderson Hill Road Purchase, NY 10577 United States. Still, Coca-Cola, which reports earnings on July 21, is likely to benefit from the same upswing in demand for beverages outside the home that helped PepsiCo during its recent quarter. Of the two stocks, analysts surveyed by Refinitiv place a more positive outlook on Coca-Cola stock than on Pepsico shares. And Pepsi has the much lower payout ratio at about 80% compared to Cokes dangerous 100%. For every seven Americans who search for "Pepsi", only one types "Coca-Cola". Plus, you can buy easy-to-carry cases of bottles and cans of your favorite brands, which are convenient to store and stack. February 20, 2013, 2:00 PM. Impressive numbers, right? 29% per year. PEP has a dividend yield of 2.55%, a payout ratio sitting at 69% of earnings, and a five-year annualized dividend growth rate of a notable 6.7%. Coca-Cola outpaces PepsiCo in terms of market share. In this section, we have analyzed the growth figures for select time ranges, namely, 1 year, 3 years, 5 years, and 10 years. In 1965, the Pepsi-Cola Company merged with Frito-Lay, Inc BibTeX @MISC{Xiao08foodmarketing, author = {Wei Xiao}, title = {Food Marketing Policy Center The Competitive and Welfare Effects of New Product Introduction: The Case of Crystal Pepsi}, year = {2008}} Pepsi might be making a smartphone Pepsi is a carbonated soft drink Coca-Colas P/E (FWD) $ 22.4 billion was Coca-Cola expects to deliver organic revenue growth of 7% - 8%, generate free cash flow of approximately $10.5 billion, and deliver comparable EPS (non-GAAP) growth of 5% - 6% for FY22. Dr. John Stith Pemberton, a local pharmacist, produced the syrup for Coca-Cola, and carried a jug of the new product down the street to Jacobs' Pharmacy, where it was sampled, pronounced "excellent" and placed on sale for five cents a glass as a soda fountain drink.. Pepsis 10-year dividend growth rate of 7.8% easily beats Cokes 6.4%. Coke (KO) is obviously famous for its Coca-Cola brand of drinks Coca-Cola saw its revenue fall 28% to $7.2 billion while adjusted EPS decreased 33% to $0.42. But when it comes to regular old cola, Coke is still king. Coke has a big lead in cola market shares than Pepsi (Coke: 42% and Pepsi: 31%). In 2013, The Coca-Cola Company generated over $35 billion in revenue from nearly 500 sparkling beverage products. Pepsi is the larger business in terms of revenue, with nearly twice as much as Coca-Cola. Coca-Cola's 2021 net revenue grew to $38.7 billion, while PepsiCo's 2021 net revenue grew to $79.47 billion. Coca-Cola boasts $44,292 million of net revenue in 2015 and PepsiCo reports $63.06bn for the same period. Coca-Cola vs Pepsi | Analyse de la concurrence.

more than $10B. The Revenue is the top line item on a declaration of revenue from which all expenses and costs are subtracted in order to reach net income. The third section will help you compare the growth in the market cap of KO and PEP. The Coca-Cola vs. PepsiCo rivalry has been around for so long that it's almost an investing cliche. Number of Employees. Both are losing to Nestl, dominating the foodindustrywith a revenue of over 90 billion dollars and a net income over 10 billion dollars. Coca-Cola and Pepsi dominate the $200 billion global soft drink and bottled water manufacturing industry. The company has shown increasing net income for the last few years, but the company has been seeing declining revenue. Search: New Pepsi Products. Coca Colas gross profits and operating earnings had been increasing from year to year: gross profits increased by 15.87% from 2006 to 2007 and by 11.48% from 2007-2008 while operating earnings increased by 14.97% from 2006 to 2007 and by 16.46% from 2006 and 2007. Coca-Cola has the 3rd rank in the Best Global Brand list annually prepared by Interbrand. Revenue. Yet Coca-Cola $64.42 billion. The product had a second life when Charles Guth, the owner of a restaurant chain, replaced Coca-Cola in the 1930s with Pepsi-Cola in his eateries. Coca-Cola is the largest beverage company in the world. Pepsi has raised its dividend 48 consecutive years. Revenue: $9.46 billion vs. $8.96 billion expected. $43.53 billion. PepsiCo delivered revenue of nearly $16 billion, which was down 3% year-over-year. Coca-Cola forecast full-year adjusted earnings per share to increase 5% to 6% from $2.32 in 2021, compared with estimates of a 6% Since the beginning of June, shares of Coca-Cola have dropped from $56 to just over $54. There was a remarkable increase in assets in 2013, which recorded a total of $77.48 billion. The flavor of Pepsi is sweeter so it's stronger initially and you taste it faster. Coke is less sweet and a little bit smoother than Pepsi. Pepsi has more sugar and caffeine than Coke. As Malcom Gladwell wrote in his 2005 book "Blink," in which he discusses the differences at length, "Pepsi, in short, is a drink built to shine in a sip test."