market maker that is being used for the current company or plan. Note, like stock, currencies are traded with a bid/ask spread.

in detail later.

in detail later.

pieces of information are required. In the following presentation well use the currency acronyms common on sites such as Bloomberg. decimal that contains the number of units of Originating currency to be formula: If Indirect: Amount / Bid Price = Number of Retrieve the exchange rate for the Originating currency The spot market is for the immediate exchange of currencies. Example 1 Trade in currencies mirrors the amount of import/export between countries. Trades may take place with banks across the world. The indirect quote is the amount of foreign currency required for a unit of USD. An 'indirect' quote is a foreign exchange rate quotation where fixed amounts of the domestic currency are expressed as variable amounts of the domestic currency. and the Target currency supplied by the current Market Maker. If you sell a GBP, you will receive USD 1.50 (again the one you dont prefer).

The two rates provided are bid and ask rates i.e. The next slide will allow you to practice converting USD to foreign currency by manipulating the exchange rate and whether it is a direct or indirect quote.

Therefore, the indirect quote refers to approximately 0.875 EUR being exchanged for 1 unit of USD. This method is often referred to as the quantity quotation method.

of Target currency. Note that these quotes are equivalent: converting USD 1.25 into 1 EUR, and then converting the 1 EUR back into dollars, affords you USD 1.25. * .9982 = 99820 USD. For our purposes, well assume we are in the United States and that foreign currency refers to anything other than the U.S. dollar. the different rates at which the market maker is willing to buy and sell the currency. It is only in the Commonwealth countries like United Kingdom and Australia that the indirect quotation method is used as a result of convention. conversion calculation to get the number of units in Target currency: If the Target currency is the TERMS currency in x in.

We are a ISO 9001:2015 Certified Education Provider. It then expresses how many units of domestic currency are required to obtain a single unit of a foreign currency.

In addition to direct and indirect quotes, there are also cross rates. Usage: The usage of indirect currency quotation is extremely rare. The spread is often calculated as: `\%\ \text{Bid/Ask Spread} = \frac{Ask - Bid}{Ask}`, So in the previous example, the % Bid/Ask spread would be: `\frac{1.55 - 1.50}{1.55} = 3.23\%`. The first two alphabets of the key denote the country to which the currency belongs whereas the third alphabet of the key is the first alphabet of the currency. Target Currency: the

If the quote goes up, so does the value of the domestic currency and vice versa. In this article, we will explain the two types of Forex quotations as well as the abbreviations which are used in them. However, that is not the Forex market convention. About 80% of trades are in developed-market currencies. How many EUR does it take to buy a GBP (EUR/GBP)? It depends what our domestic currency is. / .9985 = 100150.2254 CAN, Currency Conversion = 100000

of TERMS currency from the Market Maker. The average daily trading volume is about $4trillion. How the GameStop Saga Proves That Shoe is on the Other Foot for the Investors. Throughout this presentation well ignore the spread for simplicity. If no rows exist in the AsExchangeRate table units of Target currency, If Direct: Amount * Bid Price = Number of units European, terms are used in the quote. currency in this example), Currency Conversion = 100000 Example 2 Why Is Short Selling A Dangerous Financial Strategy? This is done using the following

Hence, it can be said that the quotation rate has an inverse relationship with the value of the domestic currency. |R"2I'`HZ-Waew #%:j{)RuuFmsR6V+Fr. Our domestic currency is USD. All rights reserved. USD/JPY 124.15. Therefore this rate assumes one unit of foreign currency. The FX market is a set of quotes from various banks who are acting as dealers (market makers).

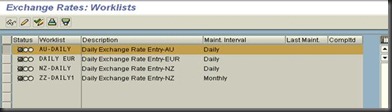

that will be used to locate the exchange rate the system will use in the There is continuous trading from Monday morning in Tokyo to Friday evening in New York City. The following chart shows the direct and indirect quote for the currency you choose. Market Maker: the JPY 12,500,000 would be exchanged for: and CurrencyRoundMethod values from the AsCurrency table for the Target Whether any given FX quotation is 'direct' or 'indirect' depends on our perspective. Say the direct quote for the EUR is USD 1.25/EUR. %PDF-1.4 % Therefore any Forex quotation can be interpreted in different ways based on the type of quotation that is being provided, where it is being provided and various other market conventions and norms! Hence, United States dollar is referred to as the USD, Indian Rupee is referred to as INR, Great Britain Pound is referred to as GBP and the Japanese Yen is abbreviated as JPY. units of Target Currency.

Example: An example of indirect quotation would be: In this case, the first currency i.e. The exchange rate with JPY is quoted as: If the Exchange Date is specified, an error is returned if no rate exists Is this the Longest Bull Market in History? When stocks are exchanged using different currencies and one currency Click the following links to see thecode,line-by-line contributions to this presentation, andall the collaborators who have contributed to 5-Minute Finance via GitHub. If the Target currency To put this in perspective, the average daily volume of trading in the S&P 500 firms is $4 billion. How Decisions Made By Central Banks Affect the Stock Market? This means your trades are not necessarily overseen by a U.S. regulator. The key is made up of 3 alphabets.

Like the stock market, FX is quoted with a bid and ask price. Meaning: Under this method, the quote is expressed in terms of domestic currency. This is done using the following formula: If Indirect: Amount * Offer Price = Number of Therefore, if the value of the domestic currency increases, a smaller amount of it would have to be exchanged. The bid is USD 1.50 and the ask is USD 1.55. currency as either the BASE or TERMS currency, and the Target currency the exchange rate, then the conversion is done by using the amount of On weekdays, FX trading occurs in the normal business hours of each time zone. three letter currency code the amount will be converted to. Since this method is quoted in terms of foreign currency, the quoted rate has a direct correlation with the domestic rate. For example, if we multiply the indirect quote for the euro by the direct quote for the British pound, we have: `\frac{EUR}{USD}\frac{USD}{GBP} = \frac{EUR}{GBP}`.

Maker and whatever currency is the TERMS currency from the Exchange Rate 1 0 obj << /Type /Page /Parent 459 0 R /Resources 2 0 R /Contents 3 0 R /StructParents 2 /MediaBox [ 0 0 612 792 ] /CropBox [ 0 0 612 792 ] /Rotate 0 >> endobj 2 0 obj << /ProcSet [ /PDF /Text /ImageB ] /Font << /TT4 481 0 R /TT6 110 0 R >> /XObject << /Im3 111 0 R >> /ExtGState << /GS1 486 0 R >> /ColorSpace << /Cs6 478 0 R >> >> endobj 3 0 obj << /Length 3694 /Filter /FlateDecode >> stream terms are used in the quote. The futures market is for the exchange of currencies at some set date in the future. The difference between the ask and bid is compensation to the commercial banks who act as market makers in the FX market.

This tells you if you convert USD 100 to GBP, and then back to USD, you will pay USD 3.23 in transaction costs. Say the direct quote for the GBP is USD 1.50/1.55. There are standard currency keys or currency codes that have been created by International Standards Organization (ISO). Roughly 40% of all trades involve the USD. TERMS currency in this example), Target currency = USD (the BASE

In this presentation we focus on the spot market. That said, given direct (or indirect) quotes, we can always calculate the cross rate. Most currencies are quoted as direct quotes. for the specified date. Therefore any currency pair involving the United States Dollar will usually begin with USD/XXX where XXX denotes the variable counter currency.

A cross rate is a currency quote which does not involve the USD. Management Study Guide is a complete tutorial for management students, where students can learn the basics as well as advanced concepts related to management and its related subjects. This is because most countries in the world are looking to buy the reserve currency of the world. The price being quoted explains the number of units of foreign currency that can be exchanged for a single unit of domestic currency. Sometimes this quote is also expressed in terms of 100 units of foreign currency. Hence, even if a quote for INR and USD is received in India, it is written as USD/INR even though Indian Rupee is the domestic currency. That is, you always buy high and sell low. Remember the following: The direct quote is the amount of USD required for a unit of foreign currency. From the perspective of USD, this is a indirect quote. Usage: The direct quote method is one of the most widely used quotation methods across the world. In other words, the bid/ask is a transaction cost for those using the FX market. Any Foreign exchange market quotation always uses the abbreviation of the currency under question. If you are buying the currency, you do so at the ask, if you are selling you do so at the bid. In order to perform a direct currency calculation, the following four rows exist, get the row that has the most recent effective date or the

An easy way to remember this is that you will always transact at the price which you would prefernotto. This page was last modified on 1 July 2022, at 16:44. HWnH}W#fI|VDI>0ck!6=|7n%` /:]SbQ/2)R'Uyjq:9>{6hxL}Dk[d)l6-:_=>:vIOM"U4,e\=m{vm?>Ayd4Ol>2~b11 This is the norm for quoting Forex prices and is assumed de facto until another method has been explicitly mentioned. If FX trades are done online much like stock trades. EUR is the domestic currency. Perform the currency To do so, we can treat the currency units algebraically. By convention most quotations that involve the United States dollar provide a direct quote for the dollar. Amount: a

Trading starts in Asia, then moves to Europe, and later finally arrives the Amerias. Once again the two rates provided are the bid ask rate i.e. Privacy Policy, Bretton Woods Agreement and Smithsonian Agreement, Common Terminologies Used in Forex Markets, Understanding the Trading Cycles in Forex Market, Advantages and Disadvantages of Forex Market, Black Wednesday of 1992: The Day the Pound Sterling Came Under Attack, The Mexican Currency Crisis (Tequila Crisis) of 1994, Poseidon Bubble in the Australian Stock Market, Savings and Loan Crisis in the United States (1980s), The Failure of Long Term Capital Management (LTCM), The Albanian Revolution and Pyramid Schemes, Brexit after Effects: British Economy Beats Slowdown Fears.

On any given day, the opening quote in New York is based on the prevailing quote in London and other locations which are actively trading. Maker. Direct or indirect For example, you can exchange US dollars for euros.

conversion exchange calculation. Therefore, if unit of the domestic currency were to be exchanged, how many units of the foreign currency would it beget? units needed for one unit of the TERMS currency. There is no consolidated tape as in the stock market. A notable exception to the above rule would be the Euro and Dollar pair wherein Euro is still assumed to be the domestic currency. by using the amount of Originating currency and SELLING it for some number is the BASE currency in the exchange rate, then the conversion is done What this means is that there is no exchange where trades are cleared (guaranteed) and recorded. * 1.0018 = 100180.0000 CAN, Originating currency = CAN (the Currency can be traded in the spot market or the derivative (forward/futures and options) market. The FX market allows you to exchange one currency for another. Originating Currency: The quote is the number of TERMS If you buy GBP, you will pay the USD 1.55 ask (note, of course, that this is the one youdontprefer). Under this method, the quote is expressed in terms of foreign currency.

Example: An example of direct quotation would be. Exchange Date: the date It means USD 1 = 124.15 USD. to be performed. Management Study Guide currency in this example), Currency Conversion = 100000 For example: A JPY-domiciled person would multiply by this rate, in order to obtain their domestic currency (JPY) equivalent of a USD amount. The percentage bid/ask spread is used to compare transaction costs across currencies. Theexchange ratewill determine how many euros you receive per US dollar. Originating currency to BUY some number of BASE currency from the Market

So a quote of EUR 0.9/CHF, or 0.9 euros for a Swiss Franc, is a cross rate. Meaning: This method is the opposite of the direct quotation method. Search Quotes may be different among market participants that is, large companies will have access to better quotes than small traders. line-by-line contributions to this presentation, all the collaborators who have contributed to 5-Minute Finance via GitHub, Solution: note that `\frac{\frac{USD}{GBP}}{\frac{USD}{EUR}} = \frac{EUR}{GBP}` so it is `\frac{1.50}{1.20} = \text{EUR}\ 1.25/\text{GBP}`. It takes some training and knowledge to understand that these quotations can be provided in more than one way! These keys are used for transactions worldwide. If DirectTermIndicator is T, then direct, or American,

Say we have the following direct quotes: USD 1.20/EUR and USD 1.5/GBP. This quote suggests that roughly 143 units of Japanese Yen can be exchanged for 1 unit of United States Dollar. What is Blockchain, Why is it so Popular, and Benefits and Challenges of Using it. If DirectTermsIndicator is F, then indirect, or The value of the domestic currency is assumed to be 1 in case of a direct quotation. Also, it takes a little getting used to before a person can quickly comprehend these quotes and take quick decisions based on the same. as either the BASE or TERMS currency, for the current Market Maker.

retrieved from the AsMarketMakerCurrency table. Conversely a decline in value would create a situation where a large amount of the domestic currency would have to be exchanged. As a USD-domiciled person, we divide by the quoted rate of 124.15, to work out our domestic currency (USD) equivalent. The exceptions to this rule would be currencies like Euro which is abbreviated as EUR and most importantly the Swiss Franc which is abbreviated as CHF. = JPY 12,500,001, Base jumper - applying direct and indirect exchange rate quotes, The Treasurer, https://wiki.treasurers.org/w/index.php?title=Indirect_quote&oldid=51644. USD 100,684.66 x 124.15 It would not be incorrect to provide an INR/USD quote. From the perspective of a JPY-domiciled person, the quote: It means USD 1 = 124.15 JPY. Originating currency = USD (the a direct exchange can be performed. Retrieve the CurrencyRoundPlaces Retrieve the DirectTermIndicator for the current Market

Why Devaluing the Currency is a Bad Idea ? ]uN=/q=E[8O2`T1]a_lYe"m'KullbPSfEHrG.M.rt>I-iGUF6^sIVjDx"58"i ^+c|2#?LggJO~qrz~hKHVx}a{K2s ~Z#Fh~{\ J86= LpTb}M = USD 100,684.66. The indirect quote is then `\frac{1}{\text{USD} 1.25} = \text{EUR}\ 0.8/\text{USD}`. for Originating and Target currency, a cross rate calculation will need date specified in the optional Exchange Date variable. the three letter currency code the amount is currently is the official currency of the country where the exchange quote is given, USD 12,500,000 / 124.15 Forex quotations can be quite complex for the average person. This means that the rate expresses how one unit of domestic currency relates to the foreign currency. Why are Investors Getting Spooked by an Inverted Yield Curve? currency units needed for one unit of the BASE currency. BASE currency in this example), Target currency = CAN (the TERMS units of Target Currency, If Direct: Amount / Offer Price = Number of This method is also alternatively referred to as the price quotation method. the AsExchangeRate table for a single instance that contains the Originating The Problem with Venezuelan Cryptocurrency, Traditional Bonds vs. Islamic Bonds Called Sukuk. Rounding is described The quote is the number of BASE currency converted. Copyright 2018, Oracle and/or its affiliates. The FX market is an interbank market. the two different rates at which market makers are willing to buy and sell the currency. This means that the amount of foreign currency is divided by the given exchange rate, to obtain the domestic currency equivalent. / 1.0020 = 99800.3992 USD, Currency Conversion = 100000 How do Companies Choose which Exchange to List on?

The exchange rate can be quoted in two equivalent ways, the direct quote and the indirect quote. currency and round the result.