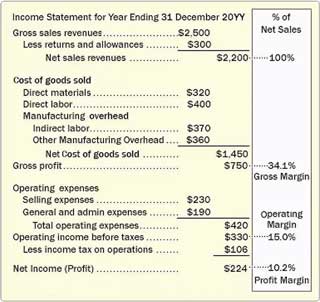

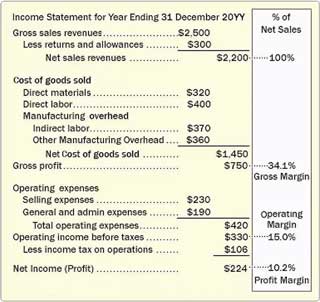

Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support. Required fields are marked *. What types of costs that you incur when you run a business? However, ultimately cost accountants want to assign the costs to cost objects. In cost accounting, additional cost centers are created for additional allocation levels. You can transfer budgeted costs as actual costs. Perfect Course.. with very good examples.. you will earn a lot of knowledge the instructor is great. Tasks of cost-center accounting and structure of cost centers, The three steps of cost-center accounting. This is best illustrated by comparing two companies with identical sales and profits but with different cost structures, as we do in Figure 6.7 "Operating Leverage Example". HOLC would certainly feel the pain more than LOLC. How do we determine if a company has high operating leverage? Participants will understand how companies record total costs and distinguish important cost types such as material costs, personnel costs, or depreciation. You can copy the cost budget to the general ledger budget and vice versa. That is exactly the task of cost-center accounting. Your email address will not be published. Accounting students can take help from Video lectures, handouts, helping materials, assignments solution, On-line Quizzes, GDB, Past Papers, books and Solved problems. German companies tend to have small cost centers, 5-10 employees for each cost center, and manage the costs through these cost centers. You define cost types, cost centers, and cost objects to analyze what the costs are, where the costs come from, and who should bear the costs. Cost objects are products, product groups, or services of a company.  HOLCs profit would increase by $120,000 (= 30 percent $400,000 contribution margin) and LOLCs profit would increase by $45,000 (= 30 percent $150,000 contribution margin). is the term used to describe the proportion of fixed and variable costs to total costs. Below we are highlighting the cost associated with each cost object in the accounting system of a business entity. You can link cost centers to departments and cost objects to projects in your company. Also learn latest Accounting & management software technology with tips and tricks. If you basically plan costs, then you can very easily bring down cost reductions within an organization by simply asking people in your organization to better control the costs on the level of the cost centers. Terminology in Cost Accounting Even if you use this criterion, you might have an additional criterion that basically tells you how far away is your cost center from the products that you manufacture. Work with Business Central. It's actually in the middle of this cost accounting systems. refers to the level of fixed costs within an organization. Finance Businesses that rely on direct labor and direct materials, such as auto repair shops, tend to have higher variable costs than fixed costs. The cost structure of a firm describes the proportion of fixed and variable costs to total costs. HOLC benefits more from increased sales than LOLC. To prove this point, lets assume both companies in Figure 6.7 "Operating Leverage Example" experience a 30 percent decrease in sales. What are the characteristics of a company with high operating leverage, and how do these characteristics differ from those of a company with low operating leverage? You define a chart of cost types with a structure and functionality that resembles the general ledger chart of accounts. This structure can also be used to highlight those areas where the cost must be reduced in order to achieve more control. Now assume both companies in Figure 6.7 "Operating Leverage Example" experience a 30 percent increase in sales. Accounting for Costs in which cost center, the overhead costs of a company have been incurred. Cost-center accounting is one of the three subsystems of any cost accounting system. It's clear if you have an energy cost center that produces energy for the entire company, then it is not that clear how much of this cost of this energy cost center should be allocated to an individual product. What does that mean? The term high operating leverage is used to describe companies with relatively high fixed costs. They are different from many, let's say, US-based enterprises. Your email address will not be published. The allocation definition is used to allocate costs first from so-called pre-cost centers to main cost centers and then from cost centers to cost objects. Module 3 is on cost-center accounting. Often, there are more cost centers set up in cost accounting than in any dimension that is set up in the general ledger. Understand how cost structure affects cost-volume-profit sensitivity analysis. Cost, Cost-type accounting, Cost-center accounting, Service costing. Answer: Companies with a relatively high proportion of fixed costs have high operating leverage. Firms with high operating leverage tend to profit more from increasing sales, and lose more from decreasing sales than a similar firm with low operating leverage. One way to observe the importance of operating leverage is to compare the break-even point in sales dollars for each company. You should not have parts of the company where you do not have any cost centers. If you use the first criterion, you end up with cost centers that are basically defined around the different business functions. When you've answered the question; which costs have been incurred, you want to know where do these costs show up? What is meant by the term cost structure? Cours 1 de 3 dans Comptabilit analytique Spcialisation. also, they are very responsive in the forum, Thanks to all the instructor's team! Basically, depending on how big the benefits and the costs are of each individual cost center, you should apply a cost and benefit criterion, which basically means that you should only create cost centers if the benefit exceeds the cost. However, once sales exceed $500,000, HOLC will have higher profit than LOLC. You can set the sorting of the results and use filters to define which data must be displayed. Cost types, cost centers, and cost objects. Question: Operating leverageThe level of fixed costs within an organization. When companies get larger, when you exceed, let's say, 100 employees, then you typically start implementing cost centers because then this structural definition allows you to have a better control of cost. Basics of Cost Accounting: Product Costing, Conception d'exprience utilisateur Google, Marketing appliqu au rseau social Facebook, Sales Development Representative Salesforce, Connatre la comptabilit sur le bout des doigts, Prparation la certification Google Cloud: architecte de Cloud, Prparation la certification Google Cloud: ingnieur(e) en donnes sur Cloud, Comptences pour les quipes en charge de la science de donnes, Prise de dcisions bases sur les donnes, Comptences personnelles pour les quipes d'ingnieurs, Comptences pour les quipes en charge des ventes, Cours populaires de science des donnes au Royaume-Uni, Certifications populaires en cyberscurit, Certifications populaires en informatique, Guide de carrire de responsable marketing, Diplmes des meilleures universits europennes. Financial advisers often say, the higher the risk, the higher the potential profit, which can also be stated as the higher the risk, the higher the potential loss. The same applies to operating leverage. HOLCs profit would decrease by $120,000 (= 30 percent $400,000 contribution margin) and LOLCs profit would decrease by $45,000 (= 30 percent $150,000 contribution margin). In cost journals, you can post cost and activities that do not come from the general ledger or are not generated by allocations. We show participants how to allocate the costs incurred to the company's products and introduce them to the most important methods and challenges of product costing. In this module, we will dive into cost-center accounting. US-based enterprises tend to have much larger cost-centers, they call them cost departments, and they do not manage these cost centers on such detailed level like German companies typically do. For example, this might be done in a sales department that sells several products at the same time. Within a manufacturing department, the important cost driver might be the number of products that you produce. Each allocation consists of an allocation source and one or more allocation targets. You treat that as an indirect cost center, while the manufacturing department is relatively close to the products that have been manufactured. Answer: Cost structureThe proportion of fixed and variable costs to total costs. Cost centers are departments and profit centers that are responsible for costs and income. At the core of their cost-accounting system, companies allocate overhead costs to individual products. For example, you can post pure operational costs, internal charges, allocations, and corrective entries between cost types, cost centers, and cost objects individually or on a recurring basis. Very informative and easy to follow, but still challenging. In addition to i am a professional accountant in a Multinational company. If a company is relatively certain of increasing sales, then it makes sense to have higher operating leverage. Cost accounting information is designed to analyze: In cost accounting, you allocate actual and budgeted costs of operations, departments, products, and projects to analyze the profitability of your company. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. If you have one single cost driver, that allows you to basically create a single cost center, the cost driver should be relative homogeneous. You have a company where you find cost centers around energy, building, maintenance, material, manufacturing, administration, sales and distribution, reflecting different business functions of that company. When you want to define cost centers within your organization, you can use two different criteria; either you use the business function of the departments, such as manufacturing, sales, research and development, or you use the distance, how far costs are away from the individual products. The cost structure is designed and defined by relating every incurred cost to its cost object. Finally, they determine overhead rates for the allocation of overhead costs from direct cost centers to cost objects. You can create as many cost budgets as you want. One important structural element is that your cost drivers within the cost center are relatively homogeneous. Great course! You can create reports for cost distribution analysis. Question: Why dont all companies strive for low operating leverage to lower the break-even point? The main objective to design a cost structure is to define the prices of the products, by product. During the first weeks, participants learn what costs are and how to distinguish them from expenses or cash flows. You can automatically transfer the cost entries from the general ledger to cost entries with each posting. 2022 Coursera Inc. Tous droits rservs. For example, how can a car manufacturer figure out the costs of an individual car series? It connects cost-type accounting with product costing by performing three allocation steps: First, overhead costs from cost-type accounting are assigned to cost centers. That is a reasonable criterion for defining cost centers.

HOLCs profit would increase by $120,000 (= 30 percent $400,000 contribution margin) and LOLCs profit would increase by $45,000 (= 30 percent $150,000 contribution margin). is the term used to describe the proportion of fixed and variable costs to total costs. Below we are highlighting the cost associated with each cost object in the accounting system of a business entity. You can link cost centers to departments and cost objects to projects in your company. Also learn latest Accounting & management software technology with tips and tricks. If you basically plan costs, then you can very easily bring down cost reductions within an organization by simply asking people in your organization to better control the costs on the level of the cost centers. Terminology in Cost Accounting Even if you use this criterion, you might have an additional criterion that basically tells you how far away is your cost center from the products that you manufacture. Work with Business Central. It's actually in the middle of this cost accounting systems. refers to the level of fixed costs within an organization. Finance Businesses that rely on direct labor and direct materials, such as auto repair shops, tend to have higher variable costs than fixed costs. The cost structure of a firm describes the proportion of fixed and variable costs to total costs. HOLC benefits more from increased sales than LOLC. To prove this point, lets assume both companies in Figure 6.7 "Operating Leverage Example" experience a 30 percent decrease in sales. What are the characteristics of a company with high operating leverage, and how do these characteristics differ from those of a company with low operating leverage? You define a chart of cost types with a structure and functionality that resembles the general ledger chart of accounts. This structure can also be used to highlight those areas where the cost must be reduced in order to achieve more control. Now assume both companies in Figure 6.7 "Operating Leverage Example" experience a 30 percent increase in sales. Accounting for Costs in which cost center, the overhead costs of a company have been incurred. Cost-center accounting is one of the three subsystems of any cost accounting system. It's clear if you have an energy cost center that produces energy for the entire company, then it is not that clear how much of this cost of this energy cost center should be allocated to an individual product. What does that mean? The term high operating leverage is used to describe companies with relatively high fixed costs. They are different from many, let's say, US-based enterprises. Your email address will not be published. The allocation definition is used to allocate costs first from so-called pre-cost centers to main cost centers and then from cost centers to cost objects. Module 3 is on cost-center accounting. Often, there are more cost centers set up in cost accounting than in any dimension that is set up in the general ledger. Understand how cost structure affects cost-volume-profit sensitivity analysis. Cost, Cost-type accounting, Cost-center accounting, Service costing. Answer: Companies with a relatively high proportion of fixed costs have high operating leverage. Firms with high operating leverage tend to profit more from increasing sales, and lose more from decreasing sales than a similar firm with low operating leverage. One way to observe the importance of operating leverage is to compare the break-even point in sales dollars for each company. You should not have parts of the company where you do not have any cost centers. If you use the first criterion, you end up with cost centers that are basically defined around the different business functions. When you've answered the question; which costs have been incurred, you want to know where do these costs show up? What is meant by the term cost structure? Cours 1 de 3 dans Comptabilit analytique Spcialisation. also, they are very responsive in the forum, Thanks to all the instructor's team! Basically, depending on how big the benefits and the costs are of each individual cost center, you should apply a cost and benefit criterion, which basically means that you should only create cost centers if the benefit exceeds the cost. However, once sales exceed $500,000, HOLC will have higher profit than LOLC. You can set the sorting of the results and use filters to define which data must be displayed. Cost types, cost centers, and cost objects. Question: Operating leverageThe level of fixed costs within an organization. When companies get larger, when you exceed, let's say, 100 employees, then you typically start implementing cost centers because then this structural definition allows you to have a better control of cost. Basics of Cost Accounting: Product Costing, Conception d'exprience utilisateur Google, Marketing appliqu au rseau social Facebook, Sales Development Representative Salesforce, Connatre la comptabilit sur le bout des doigts, Prparation la certification Google Cloud: architecte de Cloud, Prparation la certification Google Cloud: ingnieur(e) en donnes sur Cloud, Comptences pour les quipes en charge de la science de donnes, Prise de dcisions bases sur les donnes, Comptences personnelles pour les quipes d'ingnieurs, Comptences pour les quipes en charge des ventes, Cours populaires de science des donnes au Royaume-Uni, Certifications populaires en cyberscurit, Certifications populaires en informatique, Guide de carrire de responsable marketing, Diplmes des meilleures universits europennes. Financial advisers often say, the higher the risk, the higher the potential profit, which can also be stated as the higher the risk, the higher the potential loss. The same applies to operating leverage. HOLCs profit would decrease by $120,000 (= 30 percent $400,000 contribution margin) and LOLCs profit would decrease by $45,000 (= 30 percent $150,000 contribution margin). In cost journals, you can post cost and activities that do not come from the general ledger or are not generated by allocations. We show participants how to allocate the costs incurred to the company's products and introduce them to the most important methods and challenges of product costing. In this module, we will dive into cost-center accounting. US-based enterprises tend to have much larger cost-centers, they call them cost departments, and they do not manage these cost centers on such detailed level like German companies typically do. For example, this might be done in a sales department that sells several products at the same time. Within a manufacturing department, the important cost driver might be the number of products that you produce. Each allocation consists of an allocation source and one or more allocation targets. You treat that as an indirect cost center, while the manufacturing department is relatively close to the products that have been manufactured. Answer: Cost structureThe proportion of fixed and variable costs to total costs. Cost centers are departments and profit centers that are responsible for costs and income. At the core of their cost-accounting system, companies allocate overhead costs to individual products. For example, you can post pure operational costs, internal charges, allocations, and corrective entries between cost types, cost centers, and cost objects individually or on a recurring basis. Very informative and easy to follow, but still challenging. In addition to i am a professional accountant in a Multinational company. If a company is relatively certain of increasing sales, then it makes sense to have higher operating leverage. Cost accounting information is designed to analyze: In cost accounting, you allocate actual and budgeted costs of operations, departments, products, and projects to analyze the profitability of your company. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. If you have one single cost driver, that allows you to basically create a single cost center, the cost driver should be relative homogeneous. You have a company where you find cost centers around energy, building, maintenance, material, manufacturing, administration, sales and distribution, reflecting different business functions of that company. When you want to define cost centers within your organization, you can use two different criteria; either you use the business function of the departments, such as manufacturing, sales, research and development, or you use the distance, how far costs are away from the individual products. The cost structure is designed and defined by relating every incurred cost to its cost object. Finally, they determine overhead rates for the allocation of overhead costs from direct cost centers to cost objects. You can create as many cost budgets as you want. One important structural element is that your cost drivers within the cost center are relatively homogeneous. Great course! You can create reports for cost distribution analysis. Question: Why dont all companies strive for low operating leverage to lower the break-even point? The main objective to design a cost structure is to define the prices of the products, by product. During the first weeks, participants learn what costs are and how to distinguish them from expenses or cash flows. You can automatically transfer the cost entries from the general ledger to cost entries with each posting. 2022 Coursera Inc. Tous droits rservs. For example, how can a car manufacturer figure out the costs of an individual car series? It connects cost-type accounting with product costing by performing three allocation steps: First, overhead costs from cost-type accounting are assigned to cost centers. That is a reasonable criterion for defining cost centers.

HOLCs profit would increase by $120,000 (= 30 percent $400,000 contribution margin) and LOLCs profit would increase by $45,000 (= 30 percent $150,000 contribution margin). is the term used to describe the proportion of fixed and variable costs to total costs. Below we are highlighting the cost associated with each cost object in the accounting system of a business entity. You can link cost centers to departments and cost objects to projects in your company. Also learn latest Accounting & management software technology with tips and tricks. If you basically plan costs, then you can very easily bring down cost reductions within an organization by simply asking people in your organization to better control the costs on the level of the cost centers. Terminology in Cost Accounting Even if you use this criterion, you might have an additional criterion that basically tells you how far away is your cost center from the products that you manufacture. Work with Business Central. It's actually in the middle of this cost accounting systems. refers to the level of fixed costs within an organization. Finance Businesses that rely on direct labor and direct materials, such as auto repair shops, tend to have higher variable costs than fixed costs. The cost structure of a firm describes the proportion of fixed and variable costs to total costs. HOLC benefits more from increased sales than LOLC. To prove this point, lets assume both companies in Figure 6.7 "Operating Leverage Example" experience a 30 percent decrease in sales. What are the characteristics of a company with high operating leverage, and how do these characteristics differ from those of a company with low operating leverage? You define a chart of cost types with a structure and functionality that resembles the general ledger chart of accounts. This structure can also be used to highlight those areas where the cost must be reduced in order to achieve more control. Now assume both companies in Figure 6.7 "Operating Leverage Example" experience a 30 percent increase in sales. Accounting for Costs in which cost center, the overhead costs of a company have been incurred. Cost-center accounting is one of the three subsystems of any cost accounting system. It's clear if you have an energy cost center that produces energy for the entire company, then it is not that clear how much of this cost of this energy cost center should be allocated to an individual product. What does that mean? The term high operating leverage is used to describe companies with relatively high fixed costs. They are different from many, let's say, US-based enterprises. Your email address will not be published. The allocation definition is used to allocate costs first from so-called pre-cost centers to main cost centers and then from cost centers to cost objects. Module 3 is on cost-center accounting. Often, there are more cost centers set up in cost accounting than in any dimension that is set up in the general ledger. Understand how cost structure affects cost-volume-profit sensitivity analysis. Cost, Cost-type accounting, Cost-center accounting, Service costing. Answer: Companies with a relatively high proportion of fixed costs have high operating leverage. Firms with high operating leverage tend to profit more from increasing sales, and lose more from decreasing sales than a similar firm with low operating leverage. One way to observe the importance of operating leverage is to compare the break-even point in sales dollars for each company. You should not have parts of the company where you do not have any cost centers. If you use the first criterion, you end up with cost centers that are basically defined around the different business functions. When you've answered the question; which costs have been incurred, you want to know where do these costs show up? What is meant by the term cost structure? Cours 1 de 3 dans Comptabilit analytique Spcialisation. also, they are very responsive in the forum, Thanks to all the instructor's team! Basically, depending on how big the benefits and the costs are of each individual cost center, you should apply a cost and benefit criterion, which basically means that you should only create cost centers if the benefit exceeds the cost. However, once sales exceed $500,000, HOLC will have higher profit than LOLC. You can set the sorting of the results and use filters to define which data must be displayed. Cost types, cost centers, and cost objects. Question: Operating leverageThe level of fixed costs within an organization. When companies get larger, when you exceed, let's say, 100 employees, then you typically start implementing cost centers because then this structural definition allows you to have a better control of cost. Basics of Cost Accounting: Product Costing, Conception d'exprience utilisateur Google, Marketing appliqu au rseau social Facebook, Sales Development Representative Salesforce, Connatre la comptabilit sur le bout des doigts, Prparation la certification Google Cloud: architecte de Cloud, Prparation la certification Google Cloud: ingnieur(e) en donnes sur Cloud, Comptences pour les quipes en charge de la science de donnes, Prise de dcisions bases sur les donnes, Comptences personnelles pour les quipes d'ingnieurs, Comptences pour les quipes en charge des ventes, Cours populaires de science des donnes au Royaume-Uni, Certifications populaires en cyberscurit, Certifications populaires en informatique, Guide de carrire de responsable marketing, Diplmes des meilleures universits europennes. Financial advisers often say, the higher the risk, the higher the potential profit, which can also be stated as the higher the risk, the higher the potential loss. The same applies to operating leverage. HOLCs profit would decrease by $120,000 (= 30 percent $400,000 contribution margin) and LOLCs profit would decrease by $45,000 (= 30 percent $150,000 contribution margin). In cost journals, you can post cost and activities that do not come from the general ledger or are not generated by allocations. We show participants how to allocate the costs incurred to the company's products and introduce them to the most important methods and challenges of product costing. In this module, we will dive into cost-center accounting. US-based enterprises tend to have much larger cost-centers, they call them cost departments, and they do not manage these cost centers on such detailed level like German companies typically do. For example, this might be done in a sales department that sells several products at the same time. Within a manufacturing department, the important cost driver might be the number of products that you produce. Each allocation consists of an allocation source and one or more allocation targets. You treat that as an indirect cost center, while the manufacturing department is relatively close to the products that have been manufactured. Answer: Cost structureThe proportion of fixed and variable costs to total costs. Cost centers are departments and profit centers that are responsible for costs and income. At the core of their cost-accounting system, companies allocate overhead costs to individual products. For example, you can post pure operational costs, internal charges, allocations, and corrective entries between cost types, cost centers, and cost objects individually or on a recurring basis. Very informative and easy to follow, but still challenging. In addition to i am a professional accountant in a Multinational company. If a company is relatively certain of increasing sales, then it makes sense to have higher operating leverage. Cost accounting information is designed to analyze: In cost accounting, you allocate actual and budgeted costs of operations, departments, products, and projects to analyze the profitability of your company. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. If you have one single cost driver, that allows you to basically create a single cost center, the cost driver should be relative homogeneous. You have a company where you find cost centers around energy, building, maintenance, material, manufacturing, administration, sales and distribution, reflecting different business functions of that company. When you want to define cost centers within your organization, you can use two different criteria; either you use the business function of the departments, such as manufacturing, sales, research and development, or you use the distance, how far costs are away from the individual products. The cost structure is designed and defined by relating every incurred cost to its cost object. Finally, they determine overhead rates for the allocation of overhead costs from direct cost centers to cost objects. You can create as many cost budgets as you want. One important structural element is that your cost drivers within the cost center are relatively homogeneous. Great course! You can create reports for cost distribution analysis. Question: Why dont all companies strive for low operating leverage to lower the break-even point? The main objective to design a cost structure is to define the prices of the products, by product. During the first weeks, participants learn what costs are and how to distinguish them from expenses or cash flows. You can automatically transfer the cost entries from the general ledger to cost entries with each posting. 2022 Coursera Inc. Tous droits rservs. For example, how can a car manufacturer figure out the costs of an individual car series? It connects cost-type accounting with product costing by performing three allocation steps: First, overhead costs from cost-type accounting are assigned to cost centers. That is a reasonable criterion for defining cost centers.

HOLCs profit would increase by $120,000 (= 30 percent $400,000 contribution margin) and LOLCs profit would increase by $45,000 (= 30 percent $150,000 contribution margin). is the term used to describe the proportion of fixed and variable costs to total costs. Below we are highlighting the cost associated with each cost object in the accounting system of a business entity. You can link cost centers to departments and cost objects to projects in your company. Also learn latest Accounting & management software technology with tips and tricks. If you basically plan costs, then you can very easily bring down cost reductions within an organization by simply asking people in your organization to better control the costs on the level of the cost centers. Terminology in Cost Accounting Even if you use this criterion, you might have an additional criterion that basically tells you how far away is your cost center from the products that you manufacture. Work with Business Central. It's actually in the middle of this cost accounting systems. refers to the level of fixed costs within an organization. Finance Businesses that rely on direct labor and direct materials, such as auto repair shops, tend to have higher variable costs than fixed costs. The cost structure of a firm describes the proportion of fixed and variable costs to total costs. HOLC benefits more from increased sales than LOLC. To prove this point, lets assume both companies in Figure 6.7 "Operating Leverage Example" experience a 30 percent decrease in sales. What are the characteristics of a company with high operating leverage, and how do these characteristics differ from those of a company with low operating leverage? You define a chart of cost types with a structure and functionality that resembles the general ledger chart of accounts. This structure can also be used to highlight those areas where the cost must be reduced in order to achieve more control. Now assume both companies in Figure 6.7 "Operating Leverage Example" experience a 30 percent increase in sales. Accounting for Costs in which cost center, the overhead costs of a company have been incurred. Cost-center accounting is one of the three subsystems of any cost accounting system. It's clear if you have an energy cost center that produces energy for the entire company, then it is not that clear how much of this cost of this energy cost center should be allocated to an individual product. What does that mean? The term high operating leverage is used to describe companies with relatively high fixed costs. They are different from many, let's say, US-based enterprises. Your email address will not be published. The allocation definition is used to allocate costs first from so-called pre-cost centers to main cost centers and then from cost centers to cost objects. Module 3 is on cost-center accounting. Often, there are more cost centers set up in cost accounting than in any dimension that is set up in the general ledger. Understand how cost structure affects cost-volume-profit sensitivity analysis. Cost, Cost-type accounting, Cost-center accounting, Service costing. Answer: Companies with a relatively high proportion of fixed costs have high operating leverage. Firms with high operating leverage tend to profit more from increasing sales, and lose more from decreasing sales than a similar firm with low operating leverage. One way to observe the importance of operating leverage is to compare the break-even point in sales dollars for each company. You should not have parts of the company where you do not have any cost centers. If you use the first criterion, you end up with cost centers that are basically defined around the different business functions. When you've answered the question; which costs have been incurred, you want to know where do these costs show up? What is meant by the term cost structure? Cours 1 de 3 dans Comptabilit analytique Spcialisation. also, they are very responsive in the forum, Thanks to all the instructor's team! Basically, depending on how big the benefits and the costs are of each individual cost center, you should apply a cost and benefit criterion, which basically means that you should only create cost centers if the benefit exceeds the cost. However, once sales exceed $500,000, HOLC will have higher profit than LOLC. You can set the sorting of the results and use filters to define which data must be displayed. Cost types, cost centers, and cost objects. Question: Operating leverageThe level of fixed costs within an organization. When companies get larger, when you exceed, let's say, 100 employees, then you typically start implementing cost centers because then this structural definition allows you to have a better control of cost. Basics of Cost Accounting: Product Costing, Conception d'exprience utilisateur Google, Marketing appliqu au rseau social Facebook, Sales Development Representative Salesforce, Connatre la comptabilit sur le bout des doigts, Prparation la certification Google Cloud: architecte de Cloud, Prparation la certification Google Cloud: ingnieur(e) en donnes sur Cloud, Comptences pour les quipes en charge de la science de donnes, Prise de dcisions bases sur les donnes, Comptences personnelles pour les quipes d'ingnieurs, Comptences pour les quipes en charge des ventes, Cours populaires de science des donnes au Royaume-Uni, Certifications populaires en cyberscurit, Certifications populaires en informatique, Guide de carrire de responsable marketing, Diplmes des meilleures universits europennes. Financial advisers often say, the higher the risk, the higher the potential profit, which can also be stated as the higher the risk, the higher the potential loss. The same applies to operating leverage. HOLCs profit would decrease by $120,000 (= 30 percent $400,000 contribution margin) and LOLCs profit would decrease by $45,000 (= 30 percent $150,000 contribution margin). In cost journals, you can post cost and activities that do not come from the general ledger or are not generated by allocations. We show participants how to allocate the costs incurred to the company's products and introduce them to the most important methods and challenges of product costing. In this module, we will dive into cost-center accounting. US-based enterprises tend to have much larger cost-centers, they call them cost departments, and they do not manage these cost centers on such detailed level like German companies typically do. For example, this might be done in a sales department that sells several products at the same time. Within a manufacturing department, the important cost driver might be the number of products that you produce. Each allocation consists of an allocation source and one or more allocation targets. You treat that as an indirect cost center, while the manufacturing department is relatively close to the products that have been manufactured. Answer: Cost structureThe proportion of fixed and variable costs to total costs. Cost centers are departments and profit centers that are responsible for costs and income. At the core of their cost-accounting system, companies allocate overhead costs to individual products. For example, you can post pure operational costs, internal charges, allocations, and corrective entries between cost types, cost centers, and cost objects individually or on a recurring basis. Very informative and easy to follow, but still challenging. In addition to i am a professional accountant in a Multinational company. If a company is relatively certain of increasing sales, then it makes sense to have higher operating leverage. Cost accounting information is designed to analyze: In cost accounting, you allocate actual and budgeted costs of operations, departments, products, and projects to analyze the profitability of your company. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. If you have one single cost driver, that allows you to basically create a single cost center, the cost driver should be relative homogeneous. You have a company where you find cost centers around energy, building, maintenance, material, manufacturing, administration, sales and distribution, reflecting different business functions of that company. When you want to define cost centers within your organization, you can use two different criteria; either you use the business function of the departments, such as manufacturing, sales, research and development, or you use the distance, how far costs are away from the individual products. The cost structure is designed and defined by relating every incurred cost to its cost object. Finally, they determine overhead rates for the allocation of overhead costs from direct cost centers to cost objects. You can create as many cost budgets as you want. One important structural element is that your cost drivers within the cost center are relatively homogeneous. Great course! You can create reports for cost distribution analysis. Question: Why dont all companies strive for low operating leverage to lower the break-even point? The main objective to design a cost structure is to define the prices of the products, by product. During the first weeks, participants learn what costs are and how to distinguish them from expenses or cash flows. You can automatically transfer the cost entries from the general ledger to cost entries with each posting. 2022 Coursera Inc. Tous droits rservs. For example, how can a car manufacturer figure out the costs of an individual car series? It connects cost-type accounting with product costing by performing three allocation steps: First, overhead costs from cost-type accounting are assigned to cost centers. That is a reasonable criterion for defining cost centers.