That said, gold companies must operate their businesses efficiently. However, with the world trending towards electrification and carbon neutrality, non-dividend stocks may be a safer bet in this sector. SmartAssets free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Agnicos exploration activities are conducted across these countries as well as in the US and Sweden. AngloGold Ashanti Limited (NYSE: AU):Operating as a gold mining and exploration company. Since trades have not actually been executed, results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity, and may not reflect the impact that certain economic or market factors may have had on the decision-making process. That gives Southern Copper more opportunity to leverage high prices on the metalif high prices persist. Above is just a few of the gold producing companies out of many. Despite falling gold prices, the company reported third quarter revenue -- ending Sept. 29, 2012 -- of $6.872 million as opposed to second quarter revenue -- ending June 29, 2012 -- of $4.125 million. Other factors are propping up Doctor Copperthusly named because economists sometimes use the metal to gauge changes in the global economys direction. Southern Copper primarily operates in Peru and Mexico (though it also has exploration operations in Chile), and it boasts the highest copper reserves in the mining industry. Investing in gold bullion is similar to buying currency in a way. The best gold stocks that pay a dividend are looking for ways to cut costs. Buying the physical metal may be a popular way to store wealth, but this strategy does not generate income. But copper is tops by a lotthe company produced more than 965,000 tons of copper in 2021; the next-closest metal was zinc, at 66,958 tons. Lets examine a few of these stocks, which yield up to 5.4% and have expanded their payouts by as much as 10x in recent years. Thats in part because they tend to provide strongly correlated upside with the price of copper and any other metals they mind. Prior to making any investment decision, it is recommended that readers consult directly with GCM Mining and seek advice from a qualified investment advisor. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. Youll want to investigate their projects, and find out how sensitive they are to the price changes of gold. The largest gold mining company in the world, Barrick Gold has a market cap of $34.26 billion and has mining operations in North and South America, Africa and the Australia Pacific region. And this commodity just so happens to be a source of aggressive dividend growth. That upward price pressure has only grown since Russia invaded Ukraine and much of the globe fought back with sanctions.

If you continue to use this site we will assume that you are good with it. No hidden magic. The energy index rose 27.0% over the past year, and the food index increased 7.0%. The company offers investors anannual dividend of$0.06 per share. NYSE and AMEX data is at least 20 minutes delayed. Follow us on Twitter: @globeinvestorOpens in a new window, 20 TSX-listed stocks for investors worried about a looming correction, 10 TSX-listed stocks give you geographical diversification (without leaving home), 15 Canadian value stocks with great potential, Checking box will enable automatic data updates. Source: Dividend Advisor. Brett Owens is chief investment strategist for Contrarian Outlook. Please be fully informed regarding the risks and costs associated with trading, it is one of the riskiest investment forms possible. For instance, GCM Mining (TSX:GCM,OTCQX:TPRFF) offers one of the highest yields in the sector, while also being the only non-royalty-based producer to provide shareholders with a monthly dividend. Warren Buffett has only once offered a dividend in his company stock, Berkshire Hathaway. Add GOLD to your watchlist to be reminded of GOLD's next dividend payment. Its just the nature of the beast.). Just ask me, and you'll learn why there was nothing I could use out there and build the Dividend Snapshot Screeners. She received a bachelor's degree in business administration from the University of South Florida. Take the time to visit company websites and read financial statements. Their costs to produce gold can be significantly lower than the spot price. Meanwhile, the following four firms, also based in Toronto, offer solid prospects for savvy precious-metal investors: Agnico-Eagle Mines Ltd., Kirkland Lake Gold Ltd., Yamana Gold Inc. and Alamos Gold Inc. We advise investors to do additional research on any investments we identify here. In addition, it owns and manages extraction and processing facilities to produce gold dore.

No hidden magic. The energy index rose 27.0% over the past year, and the food index increased 7.0%. The company offers investors anannual dividend of$0.06 per share. NYSE and AMEX data is at least 20 minutes delayed. Follow us on Twitter: @globeinvestorOpens in a new window, 20 TSX-listed stocks for investors worried about a looming correction, 10 TSX-listed stocks give you geographical diversification (without leaving home), 15 Canadian value stocks with great potential, Checking box will enable automatic data updates. Source: Dividend Advisor. Brett Owens is chief investment strategist for Contrarian Outlook. Please be fully informed regarding the risks and costs associated with trading, it is one of the riskiest investment forms possible. For instance, GCM Mining (TSX:GCM,OTCQX:TPRFF) offers one of the highest yields in the sector, while also being the only non-royalty-based producer to provide shareholders with a monthly dividend. Warren Buffett has only once offered a dividend in his company stock, Berkshire Hathaway. Add GOLD to your watchlist to be reminded of GOLD's next dividend payment. Its just the nature of the beast.). Just ask me, and you'll learn why there was nothing I could use out there and build the Dividend Snapshot Screeners. She received a bachelor's degree in business administration from the University of South Florida. Take the time to visit company websites and read financial statements. Their costs to produce gold can be significantly lower than the spot price. Meanwhile, the following four firms, also based in Toronto, offer solid prospects for savvy precious-metal investors: Agnico-Eagle Mines Ltd., Kirkland Lake Gold Ltd., Yamana Gold Inc. and Alamos Gold Inc. We advise investors to do additional research on any investments we identify here. In addition, it owns and manages extraction and processing facilities to produce gold dore.

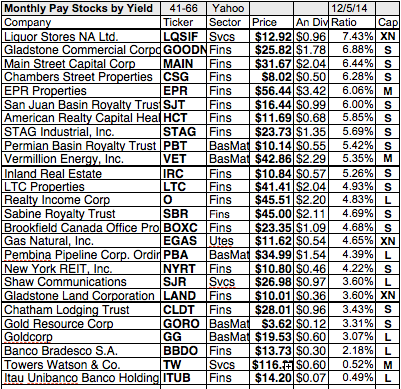

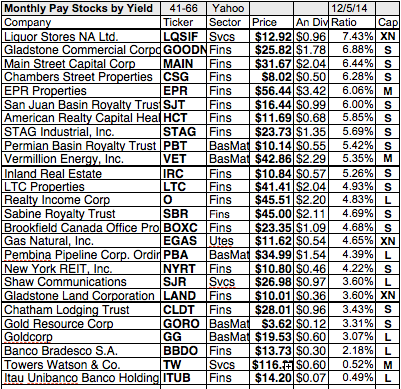

The company saw a dramatic rise in third quarter net income of $367 million compared to second quarter revenue of $279 million. Gold Stocks To Buy: Read This Before First, Gold Penny Stocks: Everything You Need To Know, Robinhood Penny Stocks: What You Need To Know, Six Gold Stocks With Dividends [Must See]. Finally, look at overall trends. Enter your email to receive our newsletter. The metal in question is copperthat versatile industrial metal thats used in everything from TVs and appliances to motors and electric generators. It has nine underground mines, one open-pit operation and several surfaces in South Africa. Sibanye Gold has a market cap that exceeds $2B. New Mexico > SmartAssets free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. When investing in any mining company, there is a specific type of high-level stock of which you should be aware. Gold value per ounce is a regular metric being shared globally through daily news alongside a countrys currency and oil prices. Backtested performance is not an indicator of future actual results. Not only has black gold set the investing world on fire, with the highest crude-oil prices seen in more than 13 yearsbut Americans are forced to watch that filter down into all-time-high gas prices. Goldcorp Inc., ticket symbol GG, pays a dividend of $0.54 and has a dividend yield of 1.50 percent. Our TSI Dividend Sustainability Rating System generated six stocks.

Like with most miners, prices in their underlying commodities matter most. Although defined by short-term volatility, the precious metal's baseline value inevitably remains consistent enough so that many investors consider gold itself to be a hedge against inflation and currency erosion. Crude oil, of course, was the first to hit orbit. Agnico Eagle is a leading gold miner having an extensive experience of more than 60 years. Gold stocks are one way investors can take advantage of future increases in gold prices. Its portfolio includes 17 mines in South Africa, Continental Africa, Australasia, and the Americas.

Crude oil, of course, was the first to hit orbit. Agnico Eagle is a leading gold miner having an extensive experience of more than 60 years. Gold stocks are one way investors can take advantage of future increases in gold prices. Its portfolio includes 17 mines in South Africa, Continental Africa, Australasia, and the Americas.

Gold Resources has a 57 percent dividend payout ratio, which means the company pays out 57 percent of its net income in the form of dividends. Involved as they are in the production and distribution of the mineral, gold-mining companies also benefit from this long-term reliability. Be certain to also examine a prospective investment's debt-to-equity ratio and avoid any company with a ratio higher than 2.00.

Many of the major players in the gold-mining industry offer dividends on their stocks, including Barrick Gold (TSX:ABX,NYSE:GOLD), Gold Resource (NYSEAMERICAN:GORO) and Newmont (TSX:NGT,NYSE:NEM). The yellow metal is approaching its all-time high of $2,089 per ounce set in August 2020. Please note all regulatory considerations regarding the presentation of fees must be taken into account. For one, its hard to find miners of any metal that can match SCCOs combination of high current yield (5%-plus) and dividend-growth history. This information is provided for illustrative purposes only. These are some of the major players in the gold mining industry that paid a dividend with some amount of consistency. That's a consistent return which means using the rule of 72, I double my portfolio every 6 years. However, there is a way for investors to gain exposure to the gold market and still generate a yield. The company recently experienced a minor 3 percent quarter-on-quarter downturn in production, but management has asserted that it's favourably positioned to declare a final cash dividend around August 2022. *Ranking is determined by TSI Dividend Sustainability Score. **Share price and market cap are in native currency. The company has mines in Canada, Finland, and Mexico. You can, however, create steady streams of income by investing in gold stocks that pay dividends. Newmont Mining has a dividend payout ratio of 37 percent.

This information is provided for illustrative purposes only. These are some of the major players in the gold mining industry that paid a dividend with some amount of consistency. That's a consistent return which means using the rule of 72, I double my portfolio every 6 years. However, there is a way for investors to gain exposure to the gold market and still generate a yield. The company recently experienced a minor 3 percent quarter-on-quarter downturn in production, but management has asserted that it's favourably positioned to declare a final cash dividend around August 2022. *Ranking is determined by TSI Dividend Sustainability Score. **Share price and market cap are in native currency. The company has mines in Canada, Finland, and Mexico. You can, however, create steady streams of income by investing in gold stocks that pay dividends. Newmont Mining has a dividend payout ratio of 37 percent.

Gold Resource Corporation, ticket symbol GORO, pays a $0.72 dividend, which translates into a generous 4.80 percent yield.

If they dont, its fair to wonder about that high dividend. Investing in Gold can be seen as a safe haven for many when confidence is low in the markets and in the economy. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. Keep Me Signed In What does "Remember Me" do? TSI Network is also affiliated with Successful Investor Wealth Management. The companys portfolio is highly diversified by commodity, geography, revenue type, and projects. Newmont, Barrick Gold, and Franco-Nevada are really the top three major dividend paying stocks if you want to invest in individual stocks. B2Golds strategic focus continues to be on generating significant growth in gold production, revenues, and cash flow by focusing on organic growth, including optimizing production from their existing gold mines, continuing exploration at and around their mines, and pursuing grassroots exploration opportunities. Investors and consumers are facing the worst bout of inflation in over 40 years, and the data from last week was grim indeed. Dividend-paying stocks in gold mining, exploration and production are an excellent addition to a balanced investment portfolio. Agnico Eagle Mines Ltd. (NYSE: AEM) is a senior Canadian gold-mining company that has produced precious metals since 1957. Receiving a dividend is a great perk for an investor. The company has a market cap of $22.62 billion and has active mines in the United States, Mexico, Ghana, Peru, Indonesia, New Zealand and Australia. Analysts predict gold mining stocks will recover in the future. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Source: Sean Pavone / iStock via Getty Images 25. Southern Copper (SCCO) is the real McCoy, in more than one way. And indeed, newmont has that, boasting a clean balance sheet that includes $5 billion in cash and investments, and $8 billion in total liquidity. The table shows Barrick Golds dividend history, including amount per share, payout frequency, declaration, record, and payment dates. DISCLOSURE:Please note that I may have a position in one or many of the holdings listed. In return, Royal Gold receives a stream of profits from these miners operations. Gold Fields has consistently had sales surpassing $2B annually over the last several years. Last year, it paid out a total of C$11.5 million. Opinions expressed by Forbes Contributors are their own. Despite its rich history, DRD Gold has a relatively small market cap, at 130M+ However, it still manages to give investors an annual dividend of $0.12 per share.

In the case of the latter, the money is typically sent to a shareholder's brokerage account. Hecla Mining Company (NYSE:HL) is another highly promising stock.

If you continue to use this site we will assume that you are good with it.

No hidden magic. The energy index rose 27.0% over the past year, and the food index increased 7.0%. The company offers investors anannual dividend of$0.06 per share. NYSE and AMEX data is at least 20 minutes delayed. Follow us on Twitter: @globeinvestorOpens in a new window, 20 TSX-listed stocks for investors worried about a looming correction, 10 TSX-listed stocks give you geographical diversification (without leaving home), 15 Canadian value stocks with great potential, Checking box will enable automatic data updates. Source: Dividend Advisor. Brett Owens is chief investment strategist for Contrarian Outlook. Please be fully informed regarding the risks and costs associated with trading, it is one of the riskiest investment forms possible. For instance, GCM Mining (TSX:GCM,OTCQX:TPRFF) offers one of the highest yields in the sector, while also being the only non-royalty-based producer to provide shareholders with a monthly dividend. Warren Buffett has only once offered a dividend in his company stock, Berkshire Hathaway. Add GOLD to your watchlist to be reminded of GOLD's next dividend payment. Its just the nature of the beast.). Just ask me, and you'll learn why there was nothing I could use out there and build the Dividend Snapshot Screeners. She received a bachelor's degree in business administration from the University of South Florida. Take the time to visit company websites and read financial statements. Their costs to produce gold can be significantly lower than the spot price. Meanwhile, the following four firms, also based in Toronto, offer solid prospects for savvy precious-metal investors: Agnico-Eagle Mines Ltd., Kirkland Lake Gold Ltd., Yamana Gold Inc. and Alamos Gold Inc. We advise investors to do additional research on any investments we identify here. In addition, it owns and manages extraction and processing facilities to produce gold dore.

No hidden magic. The energy index rose 27.0% over the past year, and the food index increased 7.0%. The company offers investors anannual dividend of$0.06 per share. NYSE and AMEX data is at least 20 minutes delayed. Follow us on Twitter: @globeinvestorOpens in a new window, 20 TSX-listed stocks for investors worried about a looming correction, 10 TSX-listed stocks give you geographical diversification (without leaving home), 15 Canadian value stocks with great potential, Checking box will enable automatic data updates. Source: Dividend Advisor. Brett Owens is chief investment strategist for Contrarian Outlook. Please be fully informed regarding the risks and costs associated with trading, it is one of the riskiest investment forms possible. For instance, GCM Mining (TSX:GCM,OTCQX:TPRFF) offers one of the highest yields in the sector, while also being the only non-royalty-based producer to provide shareholders with a monthly dividend. Warren Buffett has only once offered a dividend in his company stock, Berkshire Hathaway. Add GOLD to your watchlist to be reminded of GOLD's next dividend payment. Its just the nature of the beast.). Just ask me, and you'll learn why there was nothing I could use out there and build the Dividend Snapshot Screeners. She received a bachelor's degree in business administration from the University of South Florida. Take the time to visit company websites and read financial statements. Their costs to produce gold can be significantly lower than the spot price. Meanwhile, the following four firms, also based in Toronto, offer solid prospects for savvy precious-metal investors: Agnico-Eagle Mines Ltd., Kirkland Lake Gold Ltd., Yamana Gold Inc. and Alamos Gold Inc. We advise investors to do additional research on any investments we identify here. In addition, it owns and manages extraction and processing facilities to produce gold dore. The company saw a dramatic rise in third quarter net income of $367 million compared to second quarter revenue of $279 million. Gold Stocks To Buy: Read This Before First, Gold Penny Stocks: Everything You Need To Know, Robinhood Penny Stocks: What You Need To Know, Six Gold Stocks With Dividends [Must See]. Finally, look at overall trends. Enter your email to receive our newsletter. The metal in question is copperthat versatile industrial metal thats used in everything from TVs and appliances to motors and electric generators. It has nine underground mines, one open-pit operation and several surfaces in South Africa. Sibanye Gold has a market cap that exceeds $2B. New Mexico > SmartAssets free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. When investing in any mining company, there is a specific type of high-level stock of which you should be aware. Gold value per ounce is a regular metric being shared globally through daily news alongside a countrys currency and oil prices. Backtested performance is not an indicator of future actual results. Not only has black gold set the investing world on fire, with the highest crude-oil prices seen in more than 13 yearsbut Americans are forced to watch that filter down into all-time-high gas prices. Goldcorp Inc., ticket symbol GG, pays a dividend of $0.54 and has a dividend yield of 1.50 percent. Our TSI Dividend Sustainability Rating System generated six stocks.

Like with most miners, prices in their underlying commodities matter most. Although defined by short-term volatility, the precious metal's baseline value inevitably remains consistent enough so that many investors consider gold itself to be a hedge against inflation and currency erosion.

Crude oil, of course, was the first to hit orbit. Agnico Eagle is a leading gold miner having an extensive experience of more than 60 years. Gold stocks are one way investors can take advantage of future increases in gold prices. Its portfolio includes 17 mines in South Africa, Continental Africa, Australasia, and the Americas.

Crude oil, of course, was the first to hit orbit. Agnico Eagle is a leading gold miner having an extensive experience of more than 60 years. Gold stocks are one way investors can take advantage of future increases in gold prices. Its portfolio includes 17 mines in South Africa, Continental Africa, Australasia, and the Americas. Gold Resources has a 57 percent dividend payout ratio, which means the company pays out 57 percent of its net income in the form of dividends. Involved as they are in the production and distribution of the mineral, gold-mining companies also benefit from this long-term reliability. Be certain to also examine a prospective investment's debt-to-equity ratio and avoid any company with a ratio higher than 2.00.

Many of the major players in the gold-mining industry offer dividends on their stocks, including Barrick Gold (TSX:ABX,NYSE:GOLD), Gold Resource (NYSEAMERICAN:GORO) and Newmont (TSX:NGT,NYSE:NEM). The yellow metal is approaching its all-time high of $2,089 per ounce set in August 2020. Please note all regulatory considerations regarding the presentation of fees must be taken into account. For one, its hard to find miners of any metal that can match SCCOs combination of high current yield (5%-plus) and dividend-growth history.

This information is provided for illustrative purposes only. These are some of the major players in the gold mining industry that paid a dividend with some amount of consistency. That's a consistent return which means using the rule of 72, I double my portfolio every 6 years. However, there is a way for investors to gain exposure to the gold market and still generate a yield. The company recently experienced a minor 3 percent quarter-on-quarter downturn in production, but management has asserted that it's favourably positioned to declare a final cash dividend around August 2022. *Ranking is determined by TSI Dividend Sustainability Score. **Share price and market cap are in native currency. The company has mines in Canada, Finland, and Mexico. You can, however, create steady streams of income by investing in gold stocks that pay dividends. Newmont Mining has a dividend payout ratio of 37 percent.

This information is provided for illustrative purposes only. These are some of the major players in the gold mining industry that paid a dividend with some amount of consistency. That's a consistent return which means using the rule of 72, I double my portfolio every 6 years. However, there is a way for investors to gain exposure to the gold market and still generate a yield. The company recently experienced a minor 3 percent quarter-on-quarter downturn in production, but management has asserted that it's favourably positioned to declare a final cash dividend around August 2022. *Ranking is determined by TSI Dividend Sustainability Score. **Share price and market cap are in native currency. The company has mines in Canada, Finland, and Mexico. You can, however, create steady streams of income by investing in gold stocks that pay dividends. Newmont Mining has a dividend payout ratio of 37 percent. Gold Resource Corporation, ticket symbol GORO, pays a $0.72 dividend, which translates into a generous 4.80 percent yield.

If they dont, its fair to wonder about that high dividend. Investing in Gold can be seen as a safe haven for many when confidence is low in the markets and in the economy. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. Keep Me Signed In What does "Remember Me" do? TSI Network is also affiliated with Successful Investor Wealth Management. The companys portfolio is highly diversified by commodity, geography, revenue type, and projects. Newmont, Barrick Gold, and Franco-Nevada are really the top three major dividend paying stocks if you want to invest in individual stocks. B2Golds strategic focus continues to be on generating significant growth in gold production, revenues, and cash flow by focusing on organic growth, including optimizing production from their existing gold mines, continuing exploration at and around their mines, and pursuing grassroots exploration opportunities. Investors and consumers are facing the worst bout of inflation in over 40 years, and the data from last week was grim indeed. Dividend-paying stocks in gold mining, exploration and production are an excellent addition to a balanced investment portfolio. Agnico Eagle Mines Ltd. (NYSE: AEM) is a senior Canadian gold-mining company that has produced precious metals since 1957. Receiving a dividend is a great perk for an investor. The company has a market cap of $22.62 billion and has active mines in the United States, Mexico, Ghana, Peru, Indonesia, New Zealand and Australia. Analysts predict gold mining stocks will recover in the future. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Source: Sean Pavone / iStock via Getty Images 25. Southern Copper (SCCO) is the real McCoy, in more than one way. And indeed, newmont has that, boasting a clean balance sheet that includes $5 billion in cash and investments, and $8 billion in total liquidity. The table shows Barrick Golds dividend history, including amount per share, payout frequency, declaration, record, and payment dates. DISCLOSURE:Please note that I may have a position in one or many of the holdings listed. In return, Royal Gold receives a stream of profits from these miners operations. Gold Fields has consistently had sales surpassing $2B annually over the last several years. Last year, it paid out a total of C$11.5 million. Opinions expressed by Forbes Contributors are their own. Despite its rich history, DRD Gold has a relatively small market cap, at 130M+ However, it still manages to give investors an annual dividend of $0.12 per share.

In the case of the latter, the money is typically sent to a shareholder's brokerage account. Hecla Mining Company (NYSE:HL) is another highly promising stock.