Another potential use of replicators is liquidity management for funds of funds. In this example, if a member has invested 2,500 in this fund for one year on 30 September 2021, their fund could grow to 2,508 if no charges are applied but to 2,495 with charges applied. Deteriorating market conditions have, in the past, caused large redemption requests from traditional hedge funds and consequently forced many hedge funds to restrict investors access to capital for prolonged periods. Barclays Hedge Fund Replicator Fund Barclays Hedge Fund Replicator Fund is a UCITS fund that provides exposure to LBAR and is managed by Barclays Capital Fund Solutions, the asset management business of Barclays Capital. All other running costs are paid for by the UKRF. 1.5% while the fund is more than 10 years from its maturity date. The illustrations are not designed to provide UKRF members with a personalised projection of what their benefits may be worth at retirement. The tables below show the total expense ratio and transaction costs for each investment fund available to members of the UKRF: For the UKRF Lifestyle Fund range the table shows: For the UKRF Lifestyle (Closed) Fund range the table shows the costs for the UKRF Lifestyle (Closed) Mature Fund (where assets are invested if members do not access their retirement savings at their target date). In 2018, the Trustee completed a detailed review of the value for members offered by the AVC policies that were historically available to invest in and which are held outside the main UKRF DC investment options. Transaction costs for each default and self-select fund have been obtained for the reporting period. Hedge fund replicators also offer investors improvedtransparency in terms of performance and risk. The Trustee is confident that the AVC policies continue to offer reasonable value to members and does not expect the value for members to change. The changes to the UKRF Diversified Growth Fund also resulted in the following: More information about the DC investment funds can be found in the Statement of Investment Principles and in the Implementation Statement. An illustration is provided for this fund as it has the lowest assumed rate of growth, which is typical of gilt funds. If a member is invested in one of these funds then they are at least 10 years from the date at which they plan to access their retirement savings, therefore, this illustration starts at 10 years to retirement. A similar review was completed in 2018. The Trustee followed statutory guidance when preparing these illustrations. In the Trustees view, charges and transaction costs are likely to represent good value for members where the combination of member-borne costs and what is provided for the costs is appropriate for the membership as a whole, and when compared to other options available in the market. From December 2020, the Trustee made some changes to the investments held by the UKRF Diversified Growth Fund to reflect the application of the Trustees RI policy. Our Funds clients have access to ongoing support, including industry knowledge and expertise from across Barclays. Note on how to read this table: If a member has invested 2,500 in this fund on 30 September 2021 for one year, their fund could be 2,476 if no charges are applied but 2,473 with charges applied. An illustration is provided for this fund as this is one of the underlying investment funds within the UKRF Lifestyle Funds and is therefore incorporated within the earlier illustrations. These illustrations have been produced in line with guidance from the Department for Work and Pensions dated October 2021. A review of both the strategy and the performance of the default investment funds, and the extent to which the return on the investments (after deduction of investment charges) was consistent with the Trustees aims and objectives for the default funds; An assessment of the performance of each investment option available through the self-select range; and. The table below shows the assumed rates of growth used in the illustrations. The lower costs stem from the absence of active management as well as from the ability to trade the underlying portfolio factors in a cost-effective way. DC members of the UKRF do not pay towards the administration costs of the UKRF and therefore it is only these investment costs which are deducted from members retirement savings. Your Relationship Director is your senior point of contact, with detailed knowledge of your specific sector. RI is an approach to managing investments that aims to incorporate environmental, social and governance (ESG) factors into investment decisions, to better manage risk and generate sustainable, long-term returns. While hedge funds typically charge investors a fixed fee of 2% and performance fee of 20%, replicators generally do not carry performance-based fees and their fixed costs (reflecting mostly transactions costs) are lower. An illustration is provided for these funds as they are part of the default investment fund. Copyright 2022 Willis Towers Watson. Learn how escrow arrangements are helping businesses facing Covid-19 related disruption to achieve short-term deferrals of their defined benefit contributions. the governance structure, design and monitoring arrangements.  Following consultation with Barclays Bank PLC, the Trustee has agreed a statement of investment principles for the UKRF that sets out how the Trustee invests. The pot sizes used for the illustrations are detailed in the guidance to the illustrations above. Note on how to read this table: If a member has invested 2,500 in this fund on 30 September 2021 for one year, their fund could grow to 2,537 if no charges are applied but to 2,527 with charges applied. The current low interest rate environment is likely to continue to underpin this demand. In contrast, hedge fund replicators are designed to replicate the average performance of a broad universe of hedge funds, and therefore eliminating manager selection risk. This means that in some cases pot sizes will be projected to reduce over time in real terms.

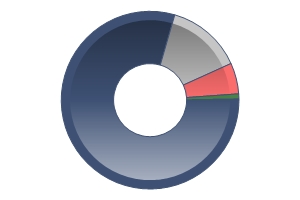

Following consultation with Barclays Bank PLC, the Trustee has agreed a statement of investment principles for the UKRF that sets out how the Trustee invests. The pot sizes used for the illustrations are detailed in the guidance to the illustrations above. Note on how to read this table: If a member has invested 2,500 in this fund on 30 September 2021 for one year, their fund could grow to 2,537 if no charges are applied but to 2,527 with charges applied. The current low interest rate environment is likely to continue to underpin this demand. In contrast, hedge fund replicators are designed to replicate the average performance of a broad universe of hedge funds, and therefore eliminating manager selection risk. This means that in some cases pot sizes will be projected to reduce over time in real terms.  ** The FCA has prescribed a methodology for calculating transaction costs known as slippage. The fact that these products are rule-based allows for complete documentation of the portfolio construction process and ex-ante risk analysis. The mid-2000s saw the creation of various hedge fund replicators whose aim was to track the aggregate performance of the hedge fund industry using liquid instruments. An illustration is provided for this fund as it is part of the default investment fund. This is because the underlying asset allocation in these funds changes over time (the glide path) and this needs to be reflected in the illustrations. Task Force on Climate-Related Financial Disclosures, Defined Contribution (DC) costs and charges, The DC default investment funds and self-select range, More information on the DC investment funds available for UKRF members, Additional Voluntary Contribution (AVC) policies, changes to the UKRF Diversified Growth Fund, the total expense ratio and the average transaction costs, UKRF Lifestyle Fund range glide path 2022 2031 Funds. Further information on each investment fund can be found in the individual fund factsheets which are available to members on ePA or from the Barclays Team. Fraudsters are working as hard as you are. All illustrations assume a growth rate for each type of investment fund that is applied at the same rate for each year of the illustration. UCITS funds that provide exposure to hedge fund replicators can provide access to a much broader spectrum of investors. The assessment reported no areas in which the DC investment arrangements detracted value.

** The FCA has prescribed a methodology for calculating transaction costs known as slippage. The fact that these products are rule-based allows for complete documentation of the portfolio construction process and ex-ante risk analysis. The mid-2000s saw the creation of various hedge fund replicators whose aim was to track the aggregate performance of the hedge fund industry using liquid instruments. An illustration is provided for this fund as it is part of the default investment fund. This is because the underlying asset allocation in these funds changes over time (the glide path) and this needs to be reflected in the illustrations. Task Force on Climate-Related Financial Disclosures, Defined Contribution (DC) costs and charges, The DC default investment funds and self-select range, More information on the DC investment funds available for UKRF members, Additional Voluntary Contribution (AVC) policies, changes to the UKRF Diversified Growth Fund, the total expense ratio and the average transaction costs, UKRF Lifestyle Fund range glide path 2022 2031 Funds. Further information on each investment fund can be found in the individual fund factsheets which are available to members on ePA or from the Barclays Team. Fraudsters are working as hard as you are. All illustrations assume a growth rate for each type of investment fund that is applied at the same rate for each year of the illustration. UCITS funds that provide exposure to hedge fund replicators can provide access to a much broader spectrum of investors. The assessment reported no areas in which the DC investment arrangements detracted value.  Our content can help you stay ahead of them. | PROD master, The Trustee of the Barclays Bank UK Retirement Fund (the UKRF), UKRF Over 5 Years Index-Linked UK Gilt Index Fund. The Trustee was pleased to note that this independent assessment reported that the UKRF offers excellent value for its DC members. There are three with-profit investments within the policy (Aviva With-Profit (NU) Standard Series 01, Series 02 and Series 04) depending upon the date in which investment in the policy started. Our dedicated team is here to provide expert solutions to businesses operating in the hedge fund industry. The Trustee is aware that statutory guidance requires the transaction costs used in the illustrations to be based on an average of the past 5 years transaction costs, however the investment managers were unable to provide data for this period. Digitalising legacy systems to increase productivity. Between 1.44% and 0.09% while the fund moves through the 10-year glide path. Further information about this change was provided to members that held investments in the UKRF Diversified Growth Fund (including members invested in the UKRF Lifestyle Fund range) in November 2020 and can be read. During the 10 years leading up to their target retirement date, these funds steadily introduce gilts and cash investment allocations before they reach their target date.

Our content can help you stay ahead of them. | PROD master, The Trustee of the Barclays Bank UK Retirement Fund (the UKRF), UKRF Over 5 Years Index-Linked UK Gilt Index Fund. The Trustee was pleased to note that this independent assessment reported that the UKRF offers excellent value for its DC members. There are three with-profit investments within the policy (Aviva With-Profit (NU) Standard Series 01, Series 02 and Series 04) depending upon the date in which investment in the policy started. Our dedicated team is here to provide expert solutions to businesses operating in the hedge fund industry. The Trustee is aware that statutory guidance requires the transaction costs used in the illustrations to be based on an average of the past 5 years transaction costs, however the investment managers were unable to provide data for this period. Digitalising legacy systems to increase productivity. Between 1.44% and 0.09% while the fund moves through the 10-year glide path. Further information about this change was provided to members that held investments in the UKRF Diversified Growth Fund (including members invested in the UKRF Lifestyle Fund range) in November 2020 and can be read. During the 10 years leading up to their target retirement date, these funds steadily introduce gilts and cash investment allocations before they reach their target date.

Support in key private equity centres, including London, New York, Dublin, Luxembourg and the Channel Islands. An illustration is provided for this fund as it has the highest level of charges and equal highest assumed rate of growth. They do this by investing in assets that are broadly the same as those in the index. Through our extensive external networks, we can provide introductions to trade bodies and industry networks that can help your businesss next steps.

Keeping up-to-speed with innovative future products such as APIs and virtual IBANs. The Trustee was pleased to note again that the 2021 independent assessment concluded that the UKRF continues to offer excellent value to its members, given the range, quality and nature of the services provided. For this reason, in October 2010 Barclays Capital launched a UCITS fund that provides exposure to its flagship hedge fund replicator. 1.44% (2031 Fund) 0.09% (2022 Fund) depending on the fund invested in. In addition, replicators address the needs of investors who do not possess the knowledge and scale to pick individual managers and would like to mitigate manager-selection risk. For the latest performance figures for each fund members should go to the Investment Performance section under Investment Information on the member pages of ePA. These hedge fund replicators are now worth revisiting, as they have the benefit of a track record lasting several years including a global financial crisis. Barclays is dedicated to helping companies take action to address the environmental and sustainability challenges facing our planet. To this end, we offer a wide range of flexible financing and deposits to support your company's green agenda. ESG criteria will be used to screen the investments in the UKRF Diversified Growth Fund and identify material ESG risks and future growth opportunities. An illustration is provided for this fund as it is part of the closed default investment fund. Are the most popular in terms of number of members invested; Are part of the default investment range. Supporting your business ESG agenda through a variety of. They will be able to provide members with the International Securities Identification Numbers (these are unique to each individual fund) of the funds that members are invested in.

These are the funds that: An illustration is provided for these funds as they are part of the default investment fund. These were the default investment funds for the UKRF over the reporting period. * In a passively managed fund, the investment manager aims to match the return of a specific index. Note on how to read this table: If a member has invested 2,500 in this fund on 30 September 2021 for one year, their fund could be 2,476 if no charges are applied but 2,474 with charges applied. Hedge fund replicators typically employ instruments such as futures and forwards that represent broad asset classes, markets and geographies and therefore offer deep liquidity.

Following consultation with Barclays Bank PLC, the Trustee has agreed a statement of investment principles for the UKRF that sets out how the Trustee invests. The pot sizes used for the illustrations are detailed in the guidance to the illustrations above. Note on how to read this table: If a member has invested 2,500 in this fund on 30 September 2021 for one year, their fund could grow to 2,537 if no charges are applied but to 2,527 with charges applied. The current low interest rate environment is likely to continue to underpin this demand. In contrast, hedge fund replicators are designed to replicate the average performance of a broad universe of hedge funds, and therefore eliminating manager selection risk. This means that in some cases pot sizes will be projected to reduce over time in real terms.

Following consultation with Barclays Bank PLC, the Trustee has agreed a statement of investment principles for the UKRF that sets out how the Trustee invests. The pot sizes used for the illustrations are detailed in the guidance to the illustrations above. Note on how to read this table: If a member has invested 2,500 in this fund on 30 September 2021 for one year, their fund could grow to 2,537 if no charges are applied but to 2,527 with charges applied. The current low interest rate environment is likely to continue to underpin this demand. In contrast, hedge fund replicators are designed to replicate the average performance of a broad universe of hedge funds, and therefore eliminating manager selection risk. This means that in some cases pot sizes will be projected to reduce over time in real terms. Support in key private equity centres, including London, New York, Dublin, Luxembourg and the Channel Islands. An illustration is provided for this fund as it has the highest level of charges and equal highest assumed rate of growth. They do this by investing in assets that are broadly the same as those in the index. Through our extensive external networks, we can provide introductions to trade bodies and industry networks that can help your businesss next steps.

Keeping up-to-speed with innovative future products such as APIs and virtual IBANs. The Trustee was pleased to note again that the 2021 independent assessment concluded that the UKRF continues to offer excellent value to its members, given the range, quality and nature of the services provided. For this reason, in October 2010 Barclays Capital launched a UCITS fund that provides exposure to its flagship hedge fund replicator. 1.44% (2031 Fund) 0.09% (2022 Fund) depending on the fund invested in. In addition, replicators address the needs of investors who do not possess the knowledge and scale to pick individual managers and would like to mitigate manager-selection risk. For the latest performance figures for each fund members should go to the Investment Performance section under Investment Information on the member pages of ePA. These hedge fund replicators are now worth revisiting, as they have the benefit of a track record lasting several years including a global financial crisis. Barclays is dedicated to helping companies take action to address the environmental and sustainability challenges facing our planet. To this end, we offer a wide range of flexible financing and deposits to support your company's green agenda. ESG criteria will be used to screen the investments in the UKRF Diversified Growth Fund and identify material ESG risks and future growth opportunities. An illustration is provided for this fund as it is part of the closed default investment fund. Are the most popular in terms of number of members invested; Are part of the default investment range. Supporting your business ESG agenda through a variety of. They will be able to provide members with the International Securities Identification Numbers (these are unique to each individual fund) of the funds that members are invested in.

These are the funds that: An illustration is provided for these funds as they are part of the default investment fund. These were the default investment funds for the UKRF over the reporting period. * In a passively managed fund, the investment manager aims to match the return of a specific index. Note on how to read this table: If a member has invested 2,500 in this fund on 30 September 2021 for one year, their fund could be 2,476 if no charges are applied but 2,474 with charges applied. Hedge fund replicators typically employ instruments such as futures and forwards that represent broad asset classes, markets and geographies and therefore offer deep liquidity.