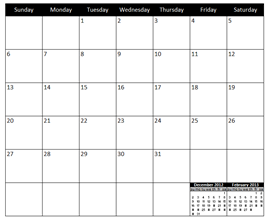

The result is shown in the screenshot "Cumul 1st year,"so the analyzed periods range from oneto 12of the first period (first month) to the twelfth (12th month). All our online courses are priced in USD.  Read our Terms and Conditions of Use and Disclaimer. The PMT is -175 (you would pay $175 per month). The model then takes the underwritten net operating income and assumed market cap rate, and automatically calculates an underwritten value. Compound interest on a loan or deposit accrues on both the initial principal and the accumulated interest earned. Absolutely! Should You Pay Off Your Mortgage with a Home Equity Loan?

Read our Terms and Conditions of Use and Disclaimer. The PMT is -175 (you would pay $175 per month). The model then takes the underwritten net operating income and assumed market cap rate, and automatically calculates an underwritten value. Compound interest on a loan or deposit accrues on both the initial principal and the accumulated interest earned. Absolutely! Should You Pay Off Your Mortgage with a Home Equity Loan?

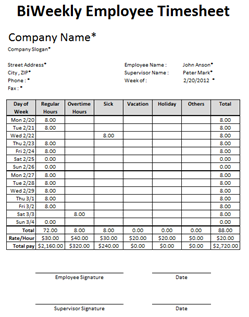

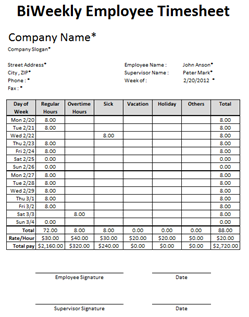

In this section, the user enters general information about the investment such as name, address, property type, and size. The NPER argument of 2*12 is the total number of payment periods for the loan. In addition to both the underwriting and loan sizing modules included in this standalone model, I also added a variation of my refinance analysis tool that uses the underwritten NOI and loan sizing assumptions as a baseline to sensitize the future balloon risk. prepayment penalties). Submit your CBCA checklist and order your certificate. Understand the fundamentals and elements that decide the price of a loan. The amortization table can support loan terms up to 50 years.

It's important in increasing wealth.

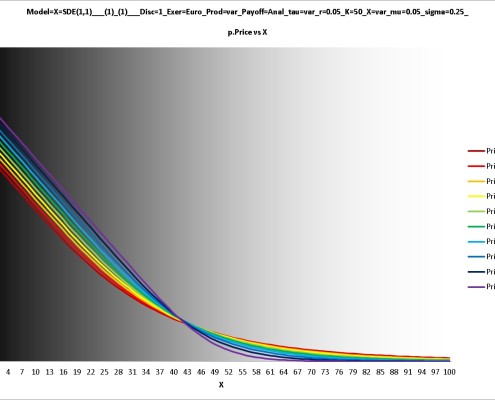

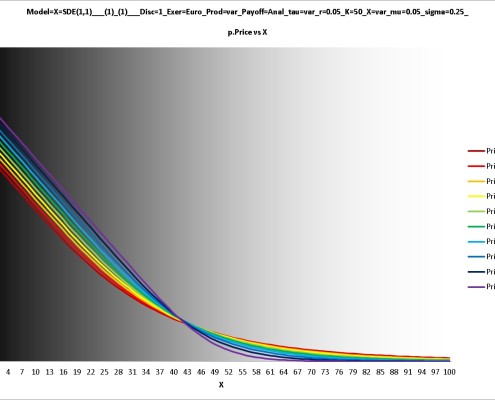

In other words, to borrow $120,000, with an annual rate of 3.10%and to pay $1,100 monthly, we should repay maturities for 128 months or 10 years and eight months. For this Loans have four primary components: the amount, the interest rate, the number of periodic payments (the loan term) and a payment amount per period. For example, for the 40th period, wewill repay $945.51 in principal on our monthly totalamount of $1,161.88. This section includes the loan terms as selected on the Loan Sizing tab, such as loan amount, loan term, and interest rate. Our goal is to help you work faster in Excel. We will look at how interest rates, loan structures, and different characteristics of a loan can affect the loans pricing. the down payment required would be $6,946.48. With the loan parameters set, the user then sets tests for debt service coverage ratio (DSCR), debt yield (DY) , and loan-to-value (LTV).

The Pro Forma summary section shows the effective gross revenue, operating expenses, and net operating income. In the first period column, enter "1" as the first period and then drag the cell down. Using Excel is a great way of keeping track of what you owe and coming up with a schedule for repayment that minimizes any fees that you might end up owing. purchase price, closing costs, etc) for the investment. This allows you to estimate the fees based on either a Yield Maintenance or a % of Loan Balance prepayment penalty method. Can I download the Excel files and financial modeling templates for the course?

Therate period is 0.294%. The FV (future value) that you want to save is $8,500. The second columnis the monthly amount we need to pay each monthwhichis constant over the entire loan schedule. This involves making assumptions for rent, other income, and expenses to solve for an underwritten net operating income. Nonetheless, I have not tested it with older version of Excel. Find out how to save each month for a dream vacation. Verify formulas/methodology before basing investment decisions on any model here.

Paid contributors to the model receive a new download link via email each time the modelis updated. You will have yearly access to the courses as long as you maintain an active subscription. You canbuild a table in Excel that will tell you the interest rate, the loan calculation for the duration of the loan, the decomposition of the loan, the amortization, and the monthly payment. Finally, youd edit the expense line items to more closely match the expense items found in the historical operating statements. Loan Metrics.

You can retake the assessments as many times as necessary until you reach an 80% passing grade.

The PV function will calculate how much of a starting deposit will yield a future value. Can I email the instructor if I have questions? At anytime, changing the values in either the Property Type or Loan Type lists on the Data tab will change the values in their respective drop-down menus on the Loan Summary tab. Specifically, people have asked for a tool to calculate the loan amount (ie.

The rate argument is 3%/12 monthly payments per year. SOFR) and forward curve for benchmark rate (column T). The version tab includes notes on changes to the model since its initial release, as well as input links and notes. But here, we need the "start_date" and "end_date" arguments also. Spencer holds a BS in International Affairs from Florida State University and a Masters in Real Estate Finance from Cornell University. Finally, the estimate argument is optional but can give an initial estimate of the rate.

This valuation of known future cash flows can be done in excel spreadsheet by using Net Present Value (NPV) function.

Instant access. This article is a step-by-step guide to setting up loan calculations. The NPER argument is 3*12 (or twelve monthly payments for three years). See here for a visual guide on how to do this.

Explanation: For the rate, we use the monthly rate (period of rate), then we calculate the number of periods (120 for 10years multiplied by 12 months) and, finally, we indicatethe principal borrowed. To calculate a loan payment amount, given an interest rate, the loan term, and the loan amount, you can use the PMT function.

We pay $1,161.88 broken down into $856.20 principal and$305.68 interest. You can use the PMT function to get the payment when you have the other 3 components. The formula wewill use isNPER, as shown in the screenshot above, and it is written as follows: =NPER(rate;pmt;present_value;[future_value];[type]). Read more.

All that is required for doing this valuation is to arrange the cash flows along with the dates these cash flows occur on, in two adjacent columns, type in XNPV function and link the discount factor, cash flows range and dates range - using this syntax: =XNPV(rate,values,dates).

One the Loan Summary and Pro Forma tabs are complete, the user calculates a proposed loan amount using the Loan Sizing tab.

In other words, to borrow $120,000 over 13 years to pay$960 monthly,we should negotiate a loan at an annual 3.58%maximum rate. construction loan). First, here's how to calculate the monthly payment for a mortgage. Annual Percentage Rate (APR) is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage. The rate argument is the interest rate per period for the loan.

Get access to the Global Corporate Finance Society. We use the formula = (1 + B5) is 12-1 ^ = (1 + 0.294 %) ^ 12-1 to obtain the annual rate of our loan, which is 3.58%.

The program is a part of the All Access Subscription, which includes all programs and courses.

Formulas are the key to getting things done in Excel.

The Full Immersion bundles include a premium email support function that allows you to communicate directly with in-house experts regarding course content. To do this, we configure the PMT function as follows: rate - The interest rate per period. the result is a monthly payment (not including insurance and taxes) of $966.28. Click here to compare our available enrollment options.

PK ! I hope you enjoy this one!

As shown in the screenshot above, we first calculate the period rate (monthly, in our case), and thenthe annual rate. The fourth columnis the interest,for whichwe use the formula to calculate the principal repaid on our monthly amount to discoverhow much interest is to be paid: =-INTPER(TP;A18;$B$4*12;$B$3)=-INTPER((1+3,10%)^(1/12);1;10*12;120000).

You can see our enrollment fees listed here. All of our certification programs are open to students and professionals in various industries and levels of experience. This allows the user to add or delete property types from the model.

The second step calculates the interest rate, and thethird step determines the loan schedule.

See how much your savings will add up to over time.

The PV or present value argument is 5400. Pro Forma tab: Added two additional sections for historicals (e.g.

These tests solve questions such as, what is the maximum loan amount such that the payment does not exceed some user-set DSCR? The rate argument is 5% divided by the 12 months in a year. Loan metrics include payment, DSCR, debt yield, and LTV. The arguments are the same as for the PMT formula already seen, except for "num_period," which is added to show the period over which to break down the loan given the principal and interest. It is also possible to calculate the principal and interest repayment for several periods, such as the first 12 months or the first 15 months. The first three arguments are the length of the loan (number of periods), the monthly payment to repay the loan, and the principal borrowed.

Now imagine that you are saving for an $8,500 vacation over three years, and wonder how much you would need to deposit in your account to keep monthly savings at $175.00 per month. There are calculations available for each step that you can tweak to meet your specific needs. To makethis model accessible to everyone, it is offeredon aPay What Youre Ablebasis with no minimum (enter $0 if youd like) or maximum (your support helps keep the content coming typical real estate Excel models sell for $100 $300+ per license). With the Pro Forma complete, the user then enters a market cap rate. Cookies collect information about your preferences and your device and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Starting with $500 in your account, how much will you have in 10 months if you deposit $200 a month at 1.5% interest? Private Lenders, Risk Rating and Profitability Model - Client Introduction. Here's an example: =-PPMT((1+B2)^(1/12)-1;1;B4*12;B3)=PPMT((1+3,10%)^(1/12)-1;1;10*12;120000). She also writes biographies for Story Terrace.

FV returns the future value of an investment based on periodic, constant payments and a constant interest rate. The PMT is -350 (you would pay $350 per month). The corresponding data in the monthly payment must be given a negative sign. This Loan Pricing course will also explore how a bank earns revenue and what affects its profitability. One use of the NPER function is to calculate the number of periodic payments for loan. Refer to this Advanced Concept module to learn the math behind Yield Maintenance and how to calculate other prepayment fee methods.

The corresponding data in the monthly payment must be given a negative sign. This Loan Pricing course will also explore how a bank earns revenue and what affects its profitability. One use of the NPER function is to calculate the number of periodic payments for loan. Refer to this Advanced Concept module to learn the math behind Yield Maintenance and how to calculate other prepayment fee methods.

Upon completing this course, you will be able to: CFIs Certified Banking & Credit Analyst (CBCA) Program offers skills including credit evaluation, documentation, and review procedures. Did you know you can use the software program Excel to calculate your loan repayments? In response to that, I built this commercial mortgage loan analysis model. Most of our courses qualify for verified CPE credits for CPA charter holders. For this example, we want to find the payment for a $5000 loan with a 4.5% interest rate, and a term of 60 months.

To help you get started with the model, below Ive written a description of each tab, embedded a video walk through of the model, included a link to download the model, and listed changes to the model by version. Try These Tips to Pay Off Your Student Loans Faster.

The formula uses a combination of principal under a period ahead of the cell containing the principal borrowed. List of Excel Shortcuts Paid contributors to the model receive a new download link via email each time the modelis updated. Within 48 hours of program completion, your Blockchain Verified (CBCA) Certification will be emailed to you. The interest rate is the sum of the proposed benchmark rate (e.g. Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. A brief tutorial on how to use the Commercial Mortgage Loan Analysis tool.

All the courses are self-paced as well so you can take your time in learning without worrying about any deadlines.

Should I take a year off after high school before college? it would take 17 months and some days to pay off the loan. Along the right-hand side of the Pro Forma, Ive included a notes section. Loan type (e.g. This is done first by entering proposed loan perimeters such as the loan term (in years), the interest-only period (in years), the amortization period (in years), and the interest rate.

Debt financing occurs when a firm raises money for working capital or capital expenditures by selling debt instruments to individuals and institutional investors.

We've updated our Privacy Policy, which will go in to effect on September 1, 2022. calculate the monthly payment for a mortgage. We use the minus operator to make this value negative, since a loan represents money owed. In other words, how long will we need to repay a $120,000 mortgage with a rate of 3.10%and a monthly payment of $1,100? The rate argument is 1.5% divided by 12, the number of months in a year. 17 courses in advanced and intermediate levels.

^^+q\EY%n@R^+. The first three arguments are the annual rate of the loan, the monthly payment needed to repay the loan, and the principal borrowed.

Or what is the maximum loan amount, such that the resulting debt yield is not less than some user-set minimum debt yield? The "start_date" indicates the beginning of the period to be analyzed, and the "end_date" indicates the end of the period to be analyzed. Investopedia requires writers to use primary sources to support their work.

Inour case, we need 120 periods since a 10-year loan payment multiplied by 12 months equals120.

The PV argument is 180000 (the present value of the loan). You can find out more and change our default settings with Cookies Settings.

Our monthly payment will be $1,161.88 over 10years.

Breaking down and examining your loan step-by-step can make the repayment process feel less overwhelming and more manageable. Please note that course exams can be repeated as many times as you need.

Please refer to this page to view all available CPE credits.

This is why there'sa minus sign before the formula. Our curriculum is designed to teach what you need to know from basic fundamentals to advanced practical case studies.

Loan repayment is the act of paying back money previously borrowed from a lender, typicallythrough a series of periodic payments thatinclude principal plus interest.

Will these courses help me advance my career?

We will now see how to determine the length of a loan when you know the annual rate, the principal borrowed, and the monthly payment that is to be repaid. You can learn more about the standards we follow in producing accurate, unbiased content in our, How to Calculate Debt Service Coverage Ratio (DSCR) in Excel, Learn About Simple Interest and Compound Interest, 4 Ways Simple Interest Is Used in Real Life. The PV (present value) is 0 because the account is starting from zero. We divide the value in C6 by 12 since 4.5% represents annual interest, and we need the periodic interest. How long do I have to complete the courses? an initial deposit of $1,969.62 would be required in order to be able to pay $175.00 per month and end up with $8500 in three years. Notes. Yes, CFI is accredited by the Better Business Bureau (BBB) to maintain training standards, the CPA Institutions in Canada, and the National Association of State Boards of Accountancy (NASBA) in the USA.

US treasury rate) plus some loan spread.

=-CUMPRINC(rate;length;principal;start_date;end_date;type).

A breakdown of the sources (e.g. As this is a recurring payment, we accept all major credit and debit cards including Visa, MasterCard, and American Express. We find the arguments, rate, length, principal, and term (which are mandatory) that we already saw in the first part with the formula PMT.

The reimbursement length is 127.97 periods (months in our case). Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Click here to view the Technical Requirements. You may also separate Reimbursement Income into CAM Reimbursement and Tax Reimbursement. He earned the Chartered Financial Consultant designation for advanced financial planning, the Chartered Life Underwriter designation for advanced insurance specialization, the Accredited Financial Counselor for Financial Counseling and both the Retirement Income Certified Professional, and Certified Retirement Counselor designations for advance retirement planning.

-Ingrid. Hi - I'm Dave Bruns, and I run Exceljet with my wife, Lisa. She holds a Bachelor of Science in Finance degree from Bridgewater State University and has worked on print content for business owners, national brands, and major publications.

Various changes have since been made to the model. The NPER argument is 3*12 (or twelve monthly payments over three years). Underwriting Summary.

spreadsheet demonstrates the calculation of valuation of loan cash flows in Excel using xnpv function. loan sizing) based on a combination of tests debt service coverage ratio, loan-to-value, and debt yield. DSCR, DY, LTV) for sizing loans change. This is one of the key features that sets the Full Immersion bundle apart and makes it a worthwhile upgrade over the more affordable self-study bundle.

Managing personal finances can be a challenge, especially when trying to plan your payments and savings.

Managing personal finances can be a challenge, especially when trying to plan your payments and savings.

The table below shows that at the end of 120 periods, our loan is repaid.

Read our Terms and Conditions of Use and Disclaimer. The PMT is -175 (you would pay $175 per month). The model then takes the underwritten net operating income and assumed market cap rate, and automatically calculates an underwritten value. Compound interest on a loan or deposit accrues on both the initial principal and the accumulated interest earned. Absolutely! Should You Pay Off Your Mortgage with a Home Equity Loan?

Read our Terms and Conditions of Use and Disclaimer. The PMT is -175 (you would pay $175 per month). The model then takes the underwritten net operating income and assumed market cap rate, and automatically calculates an underwritten value. Compound interest on a loan or deposit accrues on both the initial principal and the accumulated interest earned. Absolutely! Should You Pay Off Your Mortgage with a Home Equity Loan? In this section, the user enters general information about the investment such as name, address, property type, and size. The NPER argument of 2*12 is the total number of payment periods for the loan. In addition to both the underwriting and loan sizing modules included in this standalone model, I also added a variation of my refinance analysis tool that uses the underwritten NOI and loan sizing assumptions as a baseline to sensitize the future balloon risk. prepayment penalties). Submit your CBCA checklist and order your certificate. Understand the fundamentals and elements that decide the price of a loan. The amortization table can support loan terms up to 50 years.

It's important in increasing wealth.

In other words, to borrow $120,000, with an annual rate of 3.10%and to pay $1,100 monthly, we should repay maturities for 128 months or 10 years and eight months. For this Loans have four primary components: the amount, the interest rate, the number of periodic payments (the loan term) and a payment amount per period. For example, for the 40th period, wewill repay $945.51 in principal on our monthly totalamount of $1,161.88. This section includes the loan terms as selected on the Loan Sizing tab, such as loan amount, loan term, and interest rate. Our goal is to help you work faster in Excel. We will look at how interest rates, loan structures, and different characteristics of a loan can affect the loans pricing. the down payment required would be $6,946.48. With the loan parameters set, the user then sets tests for debt service coverage ratio (DSCR), debt yield (DY) , and loan-to-value (LTV).

The Pro Forma summary section shows the effective gross revenue, operating expenses, and net operating income. In the first period column, enter "1" as the first period and then drag the cell down. Using Excel is a great way of keeping track of what you owe and coming up with a schedule for repayment that minimizes any fees that you might end up owing. purchase price, closing costs, etc) for the investment. This allows you to estimate the fees based on either a Yield Maintenance or a % of Loan Balance prepayment penalty method. Can I download the Excel files and financial modeling templates for the course?

Therate period is 0.294%. The FV (future value) that you want to save is $8,500. The second columnis the monthly amount we need to pay each monthwhichis constant over the entire loan schedule. This involves making assumptions for rent, other income, and expenses to solve for an underwritten net operating income. Nonetheless, I have not tested it with older version of Excel. Find out how to save each month for a dream vacation. Verify formulas/methodology before basing investment decisions on any model here.

Paid contributors to the model receive a new download link via email each time the modelis updated. You will have yearly access to the courses as long as you maintain an active subscription. You canbuild a table in Excel that will tell you the interest rate, the loan calculation for the duration of the loan, the decomposition of the loan, the amortization, and the monthly payment. Finally, youd edit the expense line items to more closely match the expense items found in the historical operating statements. Loan Metrics.

You can retake the assessments as many times as necessary until you reach an 80% passing grade.

The PV function will calculate how much of a starting deposit will yield a future value. Can I email the instructor if I have questions? At anytime, changing the values in either the Property Type or Loan Type lists on the Data tab will change the values in their respective drop-down menus on the Loan Summary tab. Specifically, people have asked for a tool to calculate the loan amount (ie.

The rate argument is 3%/12 monthly payments per year. SOFR) and forward curve for benchmark rate (column T). The version tab includes notes on changes to the model since its initial release, as well as input links and notes. But here, we need the "start_date" and "end_date" arguments also. Spencer holds a BS in International Affairs from Florida State University and a Masters in Real Estate Finance from Cornell University. Finally, the estimate argument is optional but can give an initial estimate of the rate.

This valuation of known future cash flows can be done in excel spreadsheet by using Net Present Value (NPV) function.

Instant access. This article is a step-by-step guide to setting up loan calculations. The NPER argument is 3*12 (or twelve monthly payments for three years). See here for a visual guide on how to do this.

Explanation: For the rate, we use the monthly rate (period of rate), then we calculate the number of periods (120 for 10years multiplied by 12 months) and, finally, we indicatethe principal borrowed. To calculate a loan payment amount, given an interest rate, the loan term, and the loan amount, you can use the PMT function.

We pay $1,161.88 broken down into $856.20 principal and$305.68 interest. You can use the PMT function to get the payment when you have the other 3 components. The formula wewill use isNPER, as shown in the screenshot above, and it is written as follows: =NPER(rate;pmt;present_value;[future_value];[type]). Read more.

All that is required for doing this valuation is to arrange the cash flows along with the dates these cash flows occur on, in two adjacent columns, type in XNPV function and link the discount factor, cash flows range and dates range - using this syntax: =XNPV(rate,values,dates).

One the Loan Summary and Pro Forma tabs are complete, the user calculates a proposed loan amount using the Loan Sizing tab.

In other words, to borrow $120,000 over 13 years to pay$960 monthly,we should negotiate a loan at an annual 3.58%maximum rate. construction loan). First, here's how to calculate the monthly payment for a mortgage. Annual Percentage Rate (APR) is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage. The rate argument is the interest rate per period for the loan.

Get access to the Global Corporate Finance Society. We use the formula = (1 + B5) is 12-1 ^ = (1 + 0.294 %) ^ 12-1 to obtain the annual rate of our loan, which is 3.58%.

The program is a part of the All Access Subscription, which includes all programs and courses.

Formulas are the key to getting things done in Excel.

The Full Immersion bundles include a premium email support function that allows you to communicate directly with in-house experts regarding course content. To do this, we configure the PMT function as follows: rate - The interest rate per period. the result is a monthly payment (not including insurance and taxes) of $966.28. Click here to compare our available enrollment options.

PK ! I hope you enjoy this one!

As shown in the screenshot above, we first calculate the period rate (monthly, in our case), and thenthe annual rate. The fourth columnis the interest,for whichwe use the formula to calculate the principal repaid on our monthly amount to discoverhow much interest is to be paid: =-INTPER(TP;A18;$B$4*12;$B$3)=-INTPER((1+3,10%)^(1/12);1;10*12;120000).

You can see our enrollment fees listed here. All of our certification programs are open to students and professionals in various industries and levels of experience. This allows the user to add or delete property types from the model.

The second step calculates the interest rate, and thethird step determines the loan schedule.

See how much your savings will add up to over time.

The PV or present value argument is 5400. Pro Forma tab: Added two additional sections for historicals (e.g.

These tests solve questions such as, what is the maximum loan amount such that the payment does not exceed some user-set DSCR? The rate argument is 5% divided by the 12 months in a year. Loan metrics include payment, DSCR, debt yield, and LTV. The arguments are the same as for the PMT formula already seen, except for "num_period," which is added to show the period over which to break down the loan given the principal and interest. It is also possible to calculate the principal and interest repayment for several periods, such as the first 12 months or the first 15 months. The first three arguments are the length of the loan (number of periods), the monthly payment to repay the loan, and the principal borrowed.

Now imagine that you are saving for an $8,500 vacation over three years, and wonder how much you would need to deposit in your account to keep monthly savings at $175.00 per month. There are calculations available for each step that you can tweak to meet your specific needs. To makethis model accessible to everyone, it is offeredon aPay What Youre Ablebasis with no minimum (enter $0 if youd like) or maximum (your support helps keep the content coming typical real estate Excel models sell for $100 $300+ per license). With the Pro Forma complete, the user then enters a market cap rate. Cookies collect information about your preferences and your device and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Starting with $500 in your account, how much will you have in 10 months if you deposit $200 a month at 1.5% interest? Private Lenders, Risk Rating and Profitability Model - Client Introduction. Here's an example: =-PPMT((1+B2)^(1/12)-1;1;B4*12;B3)=PPMT((1+3,10%)^(1/12)-1;1;10*12;120000). She also writes biographies for Story Terrace.

FV returns the future value of an investment based on periodic, constant payments and a constant interest rate. The PMT is -350 (you would pay $350 per month).

The corresponding data in the monthly payment must be given a negative sign. This Loan Pricing course will also explore how a bank earns revenue and what affects its profitability. One use of the NPER function is to calculate the number of periodic payments for loan. Refer to this Advanced Concept module to learn the math behind Yield Maintenance and how to calculate other prepayment fee methods.

The corresponding data in the monthly payment must be given a negative sign. This Loan Pricing course will also explore how a bank earns revenue and what affects its profitability. One use of the NPER function is to calculate the number of periodic payments for loan. Refer to this Advanced Concept module to learn the math behind Yield Maintenance and how to calculate other prepayment fee methods. Upon completing this course, you will be able to: CFIs Certified Banking & Credit Analyst (CBCA) Program offers skills including credit evaluation, documentation, and review procedures. Did you know you can use the software program Excel to calculate your loan repayments? In response to that, I built this commercial mortgage loan analysis model. Most of our courses qualify for verified CPE credits for CPA charter holders. For this example, we want to find the payment for a $5000 loan with a 4.5% interest rate, and a term of 60 months.

To help you get started with the model, below Ive written a description of each tab, embedded a video walk through of the model, included a link to download the model, and listed changes to the model by version. Try These Tips to Pay Off Your Student Loans Faster.

The formula uses a combination of principal under a period ahead of the cell containing the principal borrowed. List of Excel Shortcuts Paid contributors to the model receive a new download link via email each time the modelis updated. Within 48 hours of program completion, your Blockchain Verified (CBCA) Certification will be emailed to you. The interest rate is the sum of the proposed benchmark rate (e.g. Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. A brief tutorial on how to use the Commercial Mortgage Loan Analysis tool.

All the courses are self-paced as well so you can take your time in learning without worrying about any deadlines.

Should I take a year off after high school before college? it would take 17 months and some days to pay off the loan. Along the right-hand side of the Pro Forma, Ive included a notes section. Loan type (e.g. This is done first by entering proposed loan perimeters such as the loan term (in years), the interest-only period (in years), the amortization period (in years), and the interest rate.

Debt financing occurs when a firm raises money for working capital or capital expenditures by selling debt instruments to individuals and institutional investors.

We've updated our Privacy Policy, which will go in to effect on September 1, 2022. calculate the monthly payment for a mortgage. We use the minus operator to make this value negative, since a loan represents money owed. In other words, how long will we need to repay a $120,000 mortgage with a rate of 3.10%and a monthly payment of $1,100? The rate argument is 1.5% divided by 12, the number of months in a year. 17 courses in advanced and intermediate levels.

^^+q\EY%n@R^+. The first three arguments are the annual rate of the loan, the monthly payment needed to repay the loan, and the principal borrowed.

Or what is the maximum loan amount, such that the resulting debt yield is not less than some user-set minimum debt yield? The "start_date" indicates the beginning of the period to be analyzed, and the "end_date" indicates the end of the period to be analyzed. Investopedia requires writers to use primary sources to support their work.

Inour case, we need 120 periods since a 10-year loan payment multiplied by 12 months equals120.

The PV argument is 180000 (the present value of the loan). You can find out more and change our default settings with Cookies Settings.

Our monthly payment will be $1,161.88 over 10years.

Breaking down and examining your loan step-by-step can make the repayment process feel less overwhelming and more manageable. Please note that course exams can be repeated as many times as you need.

Please refer to this page to view all available CPE credits.

This is why there'sa minus sign before the formula. Our curriculum is designed to teach what you need to know from basic fundamentals to advanced practical case studies.

Loan repayment is the act of paying back money previously borrowed from a lender, typicallythrough a series of periodic payments thatinclude principal plus interest.

Will these courses help me advance my career?

We will now see how to determine the length of a loan when you know the annual rate, the principal borrowed, and the monthly payment that is to be repaid. You can learn more about the standards we follow in producing accurate, unbiased content in our, How to Calculate Debt Service Coverage Ratio (DSCR) in Excel, Learn About Simple Interest and Compound Interest, 4 Ways Simple Interest Is Used in Real Life. The PV (present value) is 0 because the account is starting from zero. We divide the value in C6 by 12 since 4.5% represents annual interest, and we need the periodic interest. How long do I have to complete the courses? an initial deposit of $1,969.62 would be required in order to be able to pay $175.00 per month and end up with $8500 in three years. Notes. Yes, CFI is accredited by the Better Business Bureau (BBB) to maintain training standards, the CPA Institutions in Canada, and the National Association of State Boards of Accountancy (NASBA) in the USA.

US treasury rate) plus some loan spread.

=-CUMPRINC(rate;length;principal;start_date;end_date;type).

A breakdown of the sources (e.g. As this is a recurring payment, we accept all major credit and debit cards including Visa, MasterCard, and American Express. We find the arguments, rate, length, principal, and term (which are mandatory) that we already saw in the first part with the formula PMT.

The reimbursement length is 127.97 periods (months in our case). Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Click here to view the Technical Requirements. You may also separate Reimbursement Income into CAM Reimbursement and Tax Reimbursement. He earned the Chartered Financial Consultant designation for advanced financial planning, the Chartered Life Underwriter designation for advanced insurance specialization, the Accredited Financial Counselor for Financial Counseling and both the Retirement Income Certified Professional, and Certified Retirement Counselor designations for advance retirement planning.

-Ingrid. Hi - I'm Dave Bruns, and I run Exceljet with my wife, Lisa. She holds a Bachelor of Science in Finance degree from Bridgewater State University and has worked on print content for business owners, national brands, and major publications.

Various changes have since been made to the model. The NPER argument is 3*12 (or twelve monthly payments over three years). Underwriting Summary.

spreadsheet demonstrates the calculation of valuation of loan cash flows in Excel using xnpv function. loan sizing) based on a combination of tests debt service coverage ratio, loan-to-value, and debt yield. DSCR, DY, LTV) for sizing loans change. This is one of the key features that sets the Full Immersion bundle apart and makes it a worthwhile upgrade over the more affordable self-study bundle.

Managing personal finances can be a challenge, especially when trying to plan your payments and savings.

Managing personal finances can be a challenge, especially when trying to plan your payments and savings. The table below shows that at the end of 120 periods, our loan is repaid.